What is a ‘meaningfulness’ score?

By Alessandro Cirinei, Commercial Solutions Manager, Experian EMEA

Meaningfulness is about understanding how representative a bank account is for a consumer or SME (small to medium enterprise) when assessing their creditworthiness as part of a credit decision. The meaningfulness level is an index to ensure you are looking at the right amount and variety of transactions to ensure the account is meaningful.

The score is graded low, partial or high on a scale of 0-5 and this is important for the interpretation of the decisioning logic.

We use a range of factors to determine the meaningfulness of the account.

- Complexity analysis and usage pattern:

- Type and completeness of a current account

- Trend analysis:

- Historical assessment of the frequency of usage and meaningfulness of account movements

- Dynamic relations analysis:

- Verify the consistency between the relations dynamically and consistency with expectations

Why is it important?

We know that consumers and SMEs often have multiple current accounts. We find this is particularly true for SMEs, where it is very unlikely that they are operating with just one account. Therefore, to correctly assess creditworthiness, it is necessary to make sure that we are observing a significant part of the total amount of transactions for the business. We believe that the the significance of the account, whether SME or consumer, is an important preparatory insight for the generation of a score related to the probability of default risk.

Factors included in meaningfulness score development

Without first understanding the meaningfulness of the account, the lender will have limited ability to identify the true affordability and credit risk. For example, some businesses have two primary accounts and as a result they may have provided one account when applying but it may not be meaningful and therefore can have an impact on the lending decision.

Let me explain. Businesses and consumers have different habits and behaviours. For example, one business may use a current account to receive a loan but then simply transfer the loan amount into another account. A different business may have an account with lots of revenue coming in but very limited or no costs going out. This is why a meaningfulness score is important. It gives lenders clarity and confidence about whether they have enough insight to proceed to the creditworthiness check or whether they need to ask for another account. There are many reasons why individuals and companies would use accounts that are ultimately not meaningful, but the key for the lender is to increase the confidence in the decisions that are made based on the information provided. They need to ensure responsible lending.

How are Experian using this to help clients?

We are seeing two primary uses for the meaningfulness score: originations and portfolio monitoring.

In originations we look at several KPIs – including taxes, rent/mortgage, sales (for businesses), loan repayments – to understand if the account data is meaningful enough to calculate a score or not. We work with some clients that use the meaningfulness score for cut offs. They are cutting off all accounts that have a meaningfulness score less than 1 because if they know that for example, the account does not have a salary being paid in, or it lacks any variety of movement within the account, then it would not be enough to make the credit assessment, so they decide not to pass through. Some businesses may go further and say if there is no salary, they won’t even look at it.

For originations the meaningfulness score is also very important for improving the customer journey. In an ideal world a lender would want to aggregate all accounts at the same time, particularly for SMEs, because as I mentioned earlier, they often have several accounts. But aggregating multiple accounts takes time. This impacts the customer who is required to grant access to different current accounts within a consent journey. This affects the user journey and ultimately conversion in onboarding. But by using meaningfulness you can understand whether you have enough information in the account to go ahead without aggregating the other accounts – saving precious time. If the account is meaningful you can go ahead and assess creditworthiness. If the first account is not meaningful you can then ask for another one if desired.

The second most prevalent use for meaningfulness scores is portfolio monitoring. In portfolio monitoring you want to ensure a clear view, to know that any analysis on the portfolio is taking into consideration the meaningfulness of those accounts. If you’re a business looking at portfolio risk at a sector level or on a regional basis, a lack of meaningfulness will affect your KPIs. The results will be skewed and less reliable as an indicator. Within portfolio monitoring, meaningfulness is very valuable for the development of early warning strategies to establish signals coming from accounts. By determining the meaningfulness you can in turn develop the critical KPIs needed to develop early warning indicators, such as debt service coverage ratio and cashflow margin, giving you an accurate view of the remaining account liquidity to calculate vulnerability. If you don’t have these critical KPIs then it becomes harder to identify vulnerability accurately.

How is the meaningfulness score put into practice?

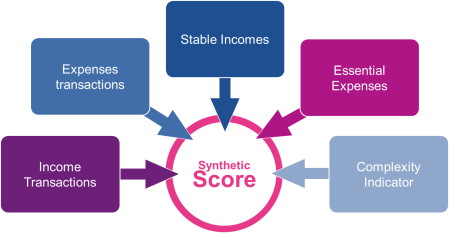

With Experian, the meaningfulness score is directly calculated in Trusso, our categorisation engine, which is powered by Machine Learning. It is part of the flow of data in the API. Machine Learning allows you to categorise the data and produce a combination of KPIs to identify the meaningfulness of the account. The categories and KPIs are ingested with several flags built to score meaningfulness – such as stable incomes, essential expenses, expense transactions. The score is built to ensure enough volume and variety of transactions.