As we emerge from the COVID-19 pandemic, we continue to feel its effects everywhere – at the grocery store, petrol stations, and in advertising. There are a number of changes impacting the advertising ecosystem, including:

- Google delays cookie deprecation until late 2024

- Apple plans to phase out its Identifier for Advertisers (IDFA)

- Alternative IDs are emerging to address cookie deprecation

- Due to federal legislation, tech companies are cracking down on consumer privacy

- Marketers and advertisers are investing in solutions that standardize the data brought into clean rooms to address interoperability issues

How best to navigate this time of uncertainty?

Our 2023 digital audience trends and predictions report provides marketers with insights we’ve gleaned about digital activation over the last four years, so that you can better plan for next year.

Our report will:

- Share Experian’s perspective on trends from 2019-2022

- Reveal our 2023 predictions

- Explore how Experian can help improve your multi-channel marketing effectiveness

There are significant changes happening in the data landscape right now, read on to stay ahead of the curve.

How has digital activation changed since 2019?

The following section focuses on the changes in Digital activation in the US market. We believe these observations remain relevant for us here in Australia. They provide a preview into the impacts of political, social and economic events. While the scale and complexity of much of the US experience is different than our own, these trends provide a useful guide to help understand the changes and developments in Digital Activation in Australia.

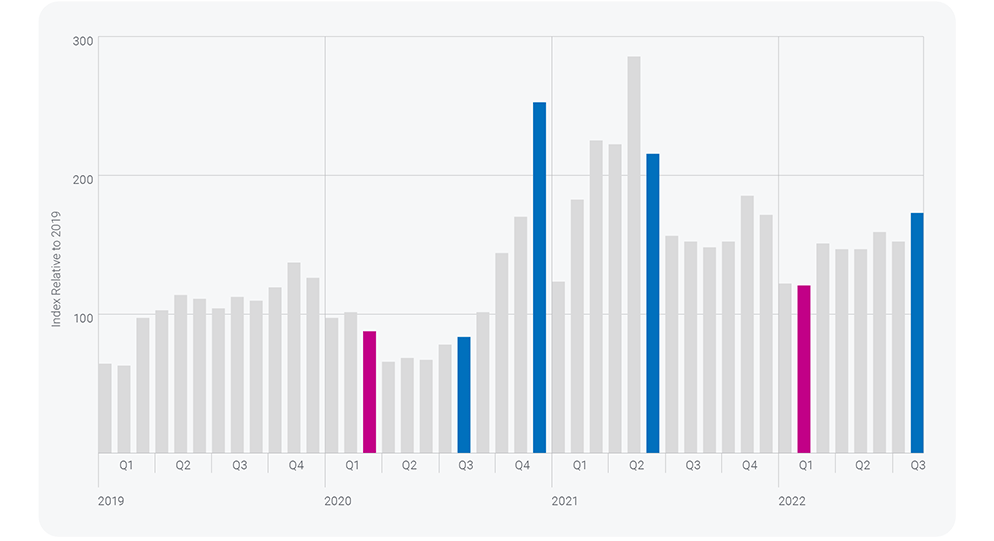

Index of media buys: 2019–2022

Here’s how we can interpret changes in digital activation from 2019-2022

Digital activation ebbs and flows in tandem with economic and media-specific events:

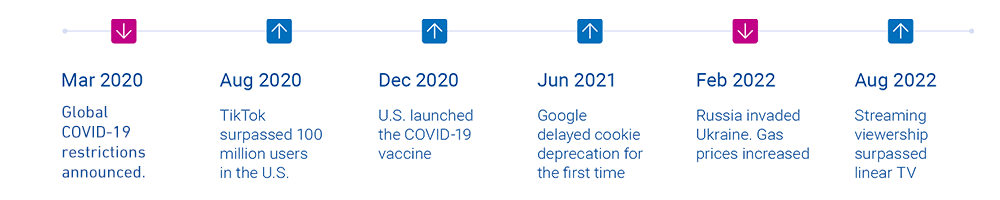

Which platforms are advertisers using to serve their ads?

Demand side, social, and video

Impressions by platform: 2019–2022

We continue to see increased demand for environments where alternative identifiers are being transacted (like demand side platforms and video). Social channels are decreasing; this can be attributed to changes in privacy, security, and concerns around brand safety. We’re also seeing a shift from traditional video to connected TVs (CTVs).

As more and more companies enter the general TV space, whether you’re a publisher, an advertiser or anyone in between that’s doing measurement, insights, analytics, our data or our services will play a role in some part of that value exchange.

– Chris Feo, SVP Sales & Partnerships, Experian1

Prediction: While we anticipate shifts given the current economic uncertainty, we predict that advertisers will dust off their recession playbooks and look toward their pandemic strategies. Marketers will look to tried and true channels and partners where they are confident that they will have quality audiences, inventory, and be able to drive ROI.

Prediction: While we anticipate shifts given the current economic uncertainty, we predict that advertisers will dust off their recession playbooks and look toward their pandemic strategies. Marketers will look to tried and true channels and partners where they are confident that they will have quality audiences, inventory, and be able to drive ROI.

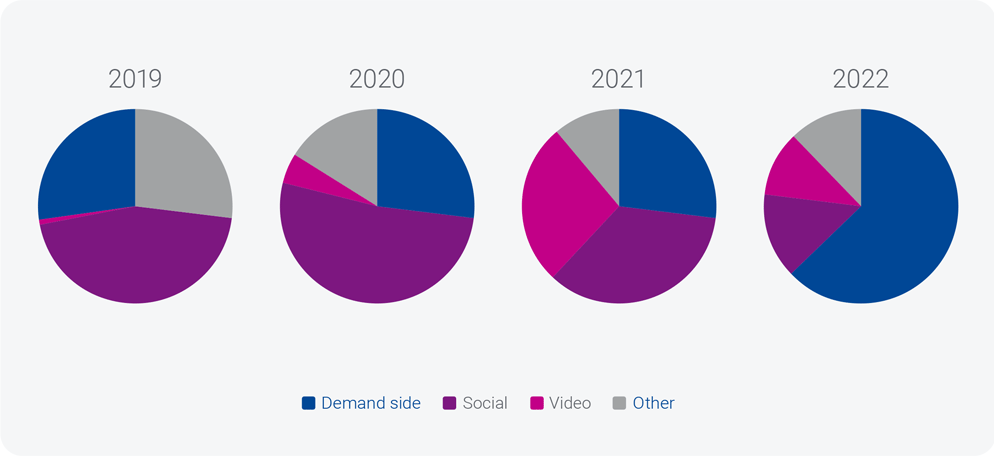

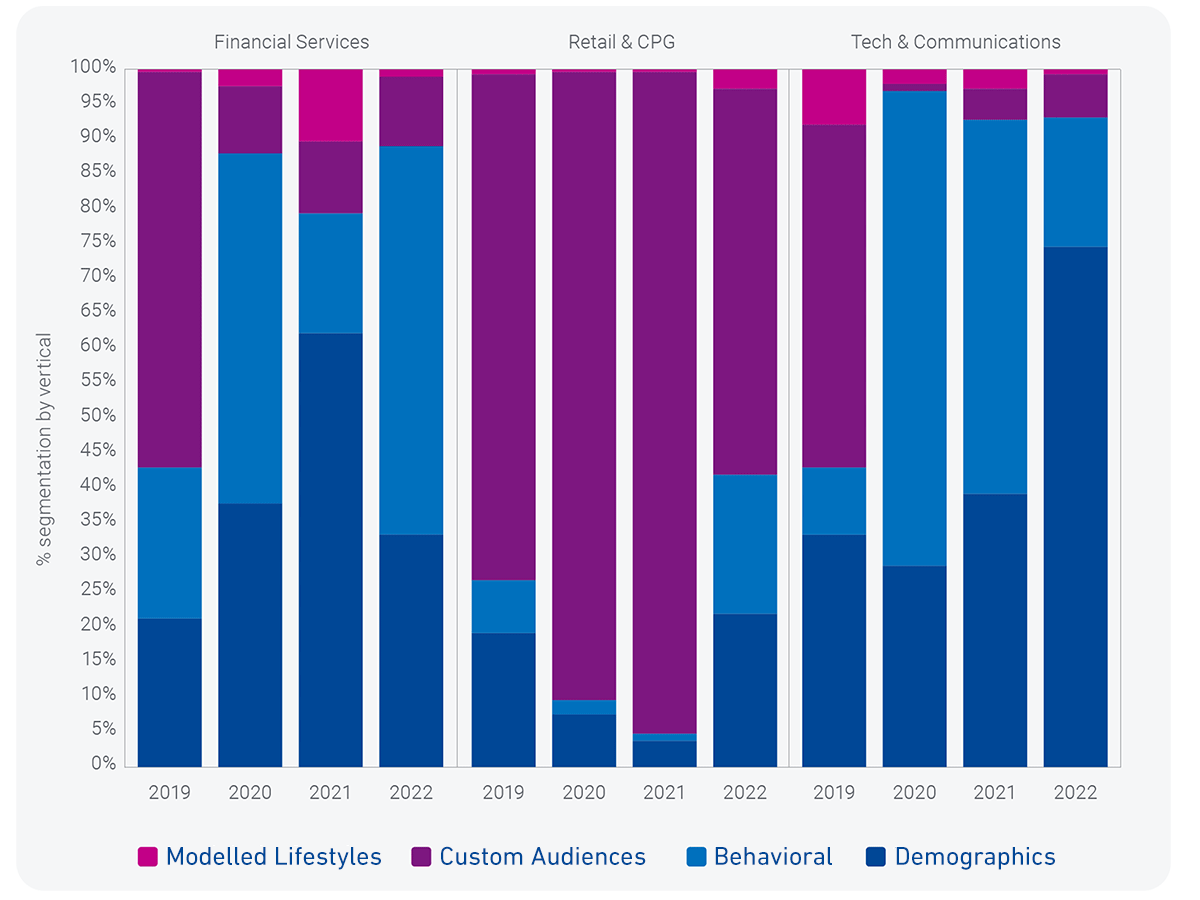

Types of digital audiences advertisers purchase from Experian

Demographics, Behavioural, Modelled Lifestyles, & Custom Audiences

Breakdown of top digital audiences by industry: 2019–2022

Audience definitions can be found in our Methodology section.

How have marketers’ audience strategies changed?

Over the last four years, Modelled Lifestyles and Custom Audience purchases represented the smallest share of activation, while Behavioural and Demographic segments were more popular with advertisers.

When the COVID-19 vaccine rolled out, consumers became more active. People were shopping in stores, returning to the gym, and taking trips that they had postponed during the height of the pandemic. As was shown in our summary of the Index of Media Buys, we saw marketing volume increase, and more specifically saw marketers turning to higher compositions of Demographic and Modelled Lifestyles to reach these audiences between April and December of 2021. Sustained growth in Demographic audience activation could suggest a move back to tried and true audience strategies as signals continue to decline and amid evolving regulation.

Prediction: We believe there may be increased pressure on marketing behaviours. With economic uncertainty, marketers return to what they know. Traditional targeting methods like Demographics and Modelled Lifestyles are the baseline of many marketing strategies and we predict that we will continue to see marketers activating against these data sets.

Prediction: We believe there may be increased pressure on marketing behaviours. With economic uncertainty, marketers return to what they know. Traditional targeting methods like Demographics and Modelled Lifestyles are the baseline of many marketing strategies and we predict that we will continue to see marketers activating against these data sets.

Digital audience trends by industry

Financial Services

Demographics and Custom Audiences

Financial Services marketers use Custom Audiences to acquire new customers through digital channels. However usage of this channel has declined considerably over the last 3 years, making way for Behavioural based audiences. These audiences delivering much improved ROI for the advertiser.

Retail & CPG

Custom Audiences

Retailers look for purchased-based data and competitive purchase behaviours when creating their target audiences. Each retailer has a specific category or competitor to analyse. Custom Audiences allow them to create an audience mix that fits their unique needs.

Technology & Communication

Demographics and Behavioural Segments

Marketers in the technology and communication industry are moving away from interest and activity-based segments and toward demographics like age, gender, and income. They are going back to basics to understand and target their consumers based on core identifiers.

In 2023, digital activation will increase

Where should you activate your audiences?

Social platforms will continue to experience volatility. Advertisers will shift their focus to demand side, video, and supply-side platforms.

- Social media ad spend is projected to be 15.9% (of total Ad spend) in 2023, but digital video (which includes CTV) will capture the most significant amount of ad spend in 2023 with 22.4%.2

- With Snap, we saw brand volatility, a decline in stock price, and a shift in ad spend toward CTV.3

- After Elon Musk’s Twitter takeover in October 2022, half of Twitter’s top 100 advertisers left the platform and have started to seek out alternatives.4

- We can help you find and target your audiences across 60+ partnerships, hundreds of end points, and measure ROI through closed-loop campaign reporting.

Demand side platforms are testing the waters, laying a path toward a post-cookie future.

- Google delayed cookie deprecation once again to 2024.

- Alternative IDs are emerging to address cookie deprecation. The Trade Desk leads the way with UID2 and reported strong results with 31% growth in Q3 2022.5

- Amazon’s DSP is catching up to Google and Meta and becoming a top advertising platform.

- Experian is dedicated to being interoperable with all cookie less IDs. Our goal is to accelerate the adoption, scale, and utility of alternative signals while remaining agnostic.

Digital video and other video channels (OTT, CTV) will continue to grow.

- Advertisers are placing bigger bets on the combination of addressable and CTV.

- The Media Rating Council stripped Nielsen of its legacy local and national TV measurement accreditation in August 2021.6 Since then, advertisers, publishers, brands, and agencies are turning to alternative, digital-first measurement providers.

- Brands, media companies and technology vendors are all exploring strategies around alternative TV ad currencies.

- As TV becomes more sophisticated, Experian’s data and services will enable you to unlock a more holistic identity. Our data powers measurement, audience insights, and results for businesses within the TV space.

We will see a refocus on sell-side partnerships.

- Data sharing relationships will become strongest on the sell-side as we move toward consented first-party data.

- Ad dollars are shifting to channels that are using the sell-side approach like retail media and CTV.

- We recently announced several supply-side partnerships. Our data ensures buyers reach the right people.

Turn prospects into customers with the right audience

Marketers will double down on audience strategies that have proven ROI and these strategies will likely be industry specific.

Modelled Lifestyles are the quickest to pull off-the-shelf when you need to get in market fast. While Health, Technology and Communications marketers rely on Demographics and Behavioral segments, Retail and CPG marketers utilise Custom Audiences and Financial Services marketers use a combination of Demographics and Custom Audiences. Experian capabilities enable all marketers to have more meaningful interactions and drive results.

Understand your customers better so you can find more like them.

At Experian, we power better results.

Methodology

Experian tracks digital usage of its data by advertisers, whether obtained through public exchanges or deployed by Experian to an intended destination. This report showcases data from January 2019-September 2022. In this report, the verticals shown are the industry to which the advertisers are classified by Experian.

Digital audience definitions

Behavioural: This audience allows marketers to identify households that are more likely to engage in certain activities or belong to certain groups.

Custom Audience: This is an audience blended from multiple sources or derived from first-party look-alike modelling.

Demographics: Examples include age, gender, relationship status, living situation, life experience, and employment.

Modelled Lifestyles: Experian’s Mosaic® USA segmentation. This is a household-based consumer lifestyle segmentation system that classifies all U.S. households and neighbourhoods into 71 unique types and 19 overarching groups, providing a 360-degree view of consumers’ choices, preferences, and habits.

Footnotes

- Broadcasting & Cable. Experian Benefits From Television’s Data Boom. September 2022.

- 2023 Outlook Survey: Ad Spend, Opportunities, and Strategies for Growth. November 2022.

- The Verge. Snap plans to lay off 20 percent of employees. August 2022.

- Twitter has lost 50 of its top 100 advertisers since Elon Musk took over, report says. November 2022.

- The Trade Desk. The Trade Desk Reports Third Quarter 2022 Financial Results. November 2022.

- MRC Strips Nielsen Of Its National, Local TV Accreditation. September 2021.

- Experian and Yieldmo team up to offer creative-enhanced data products, boosting outcomes for buyers. October 2022.