Data quality, is a key enabler for business agility

In our latest study, we heard from over 900 business leaders on their perception of data quality for business agility.

We found that the majority of respondents are actively investing in their data management so they can proactively respond to market shifts and consumer trends.

Business and data agility go hand-in-hand and, when underpinned by data quality, organisations can be confident in their market readiness. With high-quality contact data, customers become more reachable, giving businesses a competitive edge and opportunity for business growth.

In this article, we answer our most asked questions from our recent webinar. Complete your information below to access the webinar in full.

1. How is business agility and data agility different?

Data agility is a subset of business agility. Our study defines business agility as the ability to pivot strategies, development, expectations, and engagement. While data agility is defined as the distance between the data that informs a decision and the decision itself.

Our research shows us that agility is a must have in today’s environment. In fact, 94% of business leaders believe having agility in both business and data practices is important in responding to a pandemic!

2. Any insights you can share specifically around credit unions?

Yes! A recent case study from a credit union shows how a senior-level employee was processing and checking borrower data in Excel for 65 hours per month before being able to include the data. By automating data quality through Experian’s data quality platform – with pre-built rules – we were able to decrease manual processing for that employee by 77%.

Further, 15% of survey respondents worked in the finance services sector—in addition to retail, education, healthcare and more—which tells us that financial institutions like credit unions are becoming more aware of their data quality practices, and are recognising the impact data quality has on their ability to manage risk and grow their business.

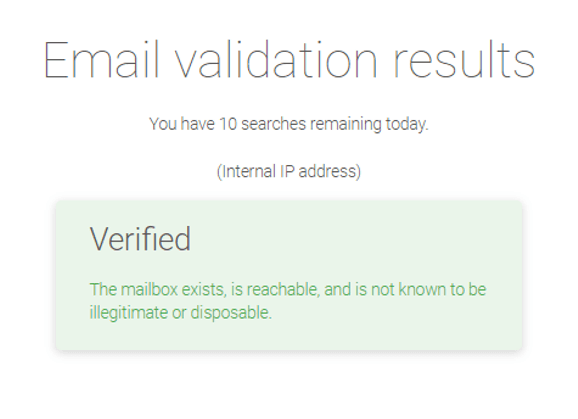

3. Can you identify business vs personal emails?

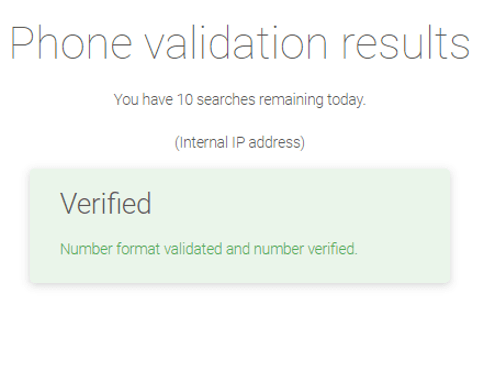

Yes! In fact, we are seeing an uptick in the need for business vs. personal email identification across industries. Identifying business and personal emails can enable you to comply with third-party disclosures while also increasing the reachability of consumers.

Additionally, email is a preferred channel by consumers which means email data has become the top contact record that organisations want. There are several ways to capture and validate this information. With validated emails and identification of what type of email it is, you can be confident that you are reaching your consumers through the right channels.

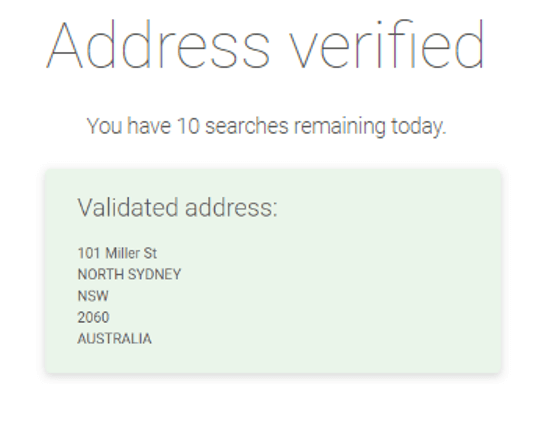

4. Can you send a list of what metadata is available for your validation services?

Yes! At Experian, we make your data fit for purpose. In other words, we can validate your contact data information while also providing metadata on the backend to ensure you have a robust view of who your customers are and how to reach them—not only will this enhance your marketing capabilities but can also help you prevent fraud.