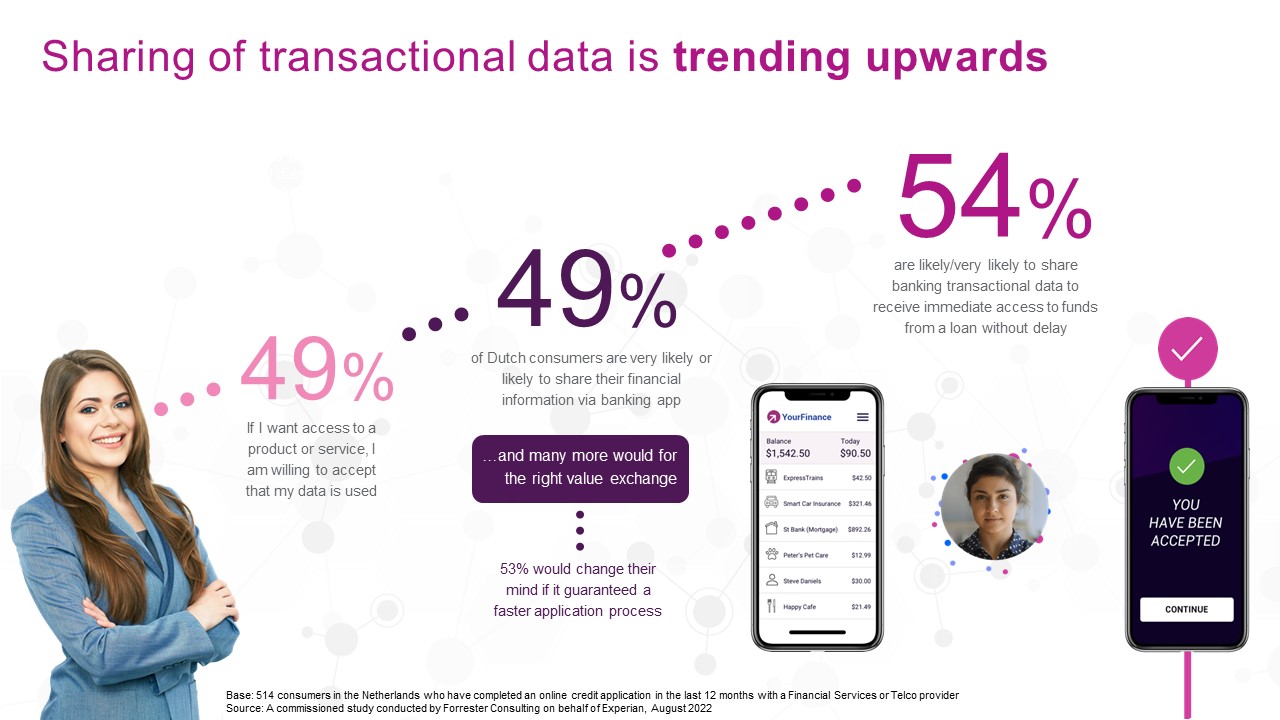

Consumer attitudes to privacy and data sharing

Dutch consumers will share their data but concerns around privacy and data use remain. Businesses must clearly explain the value benefit to sharing data and reassure consumers how their data is protected.

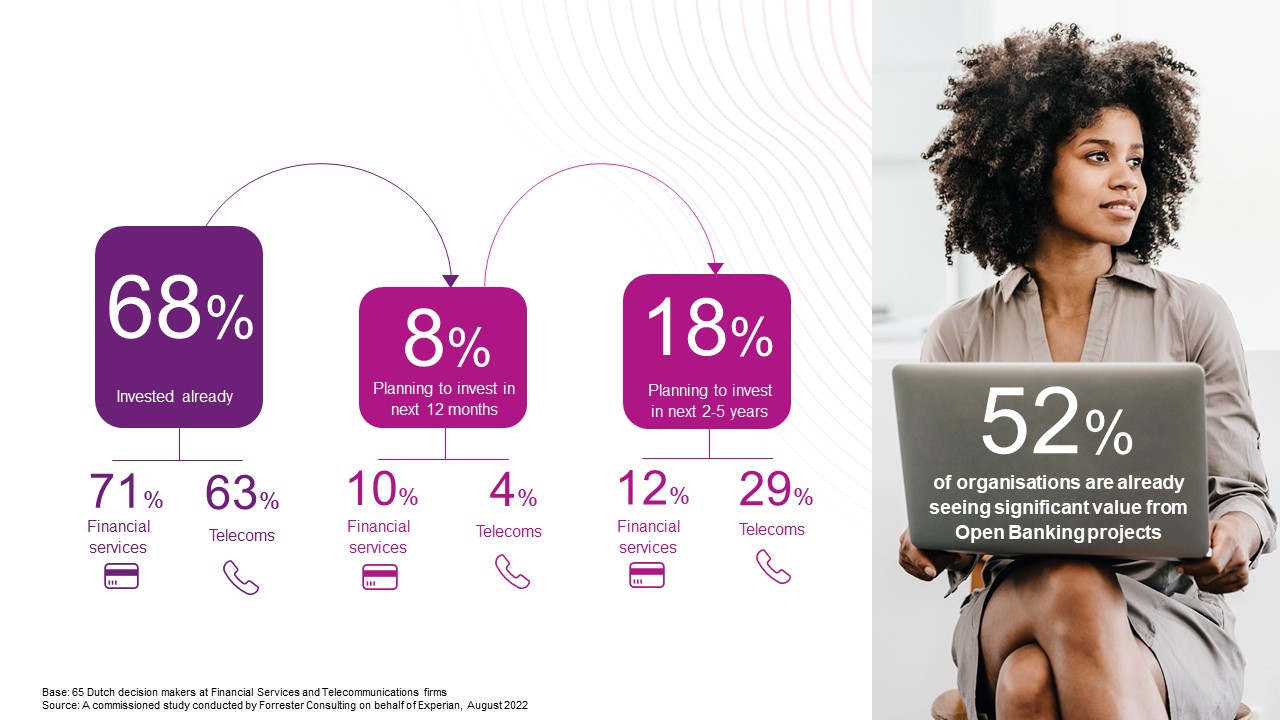

Open Banking

Open Banking is creating huge opportunities with a broad range of use cases. Firms are mainly prioritising four Open Banking use cases: employment verification (76%), income verification (69%), affordability assessments (69%) and payment services (69%). Many of them recognise that Open Banking data will improve key processes behind creditworthiness and affordability assessments.

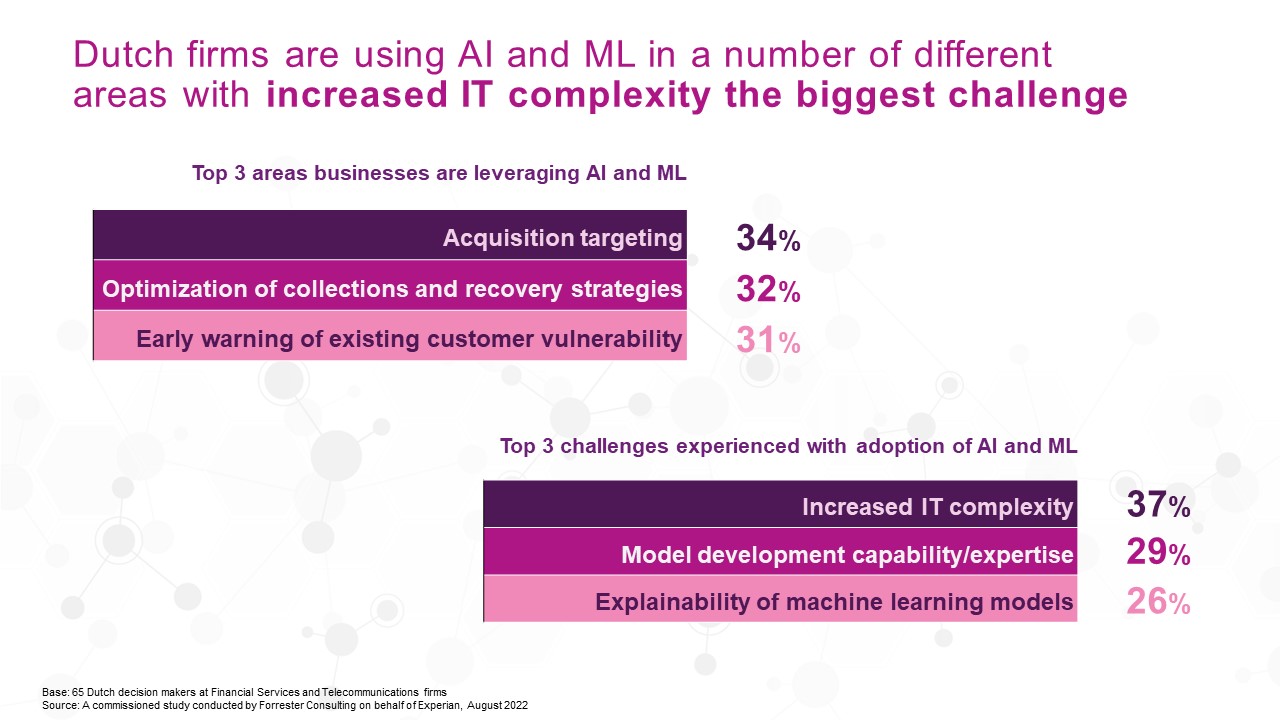

Advanced Intelligence & Machine Learning

Adopting advanced analytics capabilities was the biggest priority for Dutch businesses over the next 12 months, highlighting the importance of AI and ML to improve operational performance. Firms that have adopted advanced analytics already see the value, and they are primarily using AI/ML for acquisition targeting, optimisation of collections and recovery strategies and early warning of customer vulnerability.

Cloud

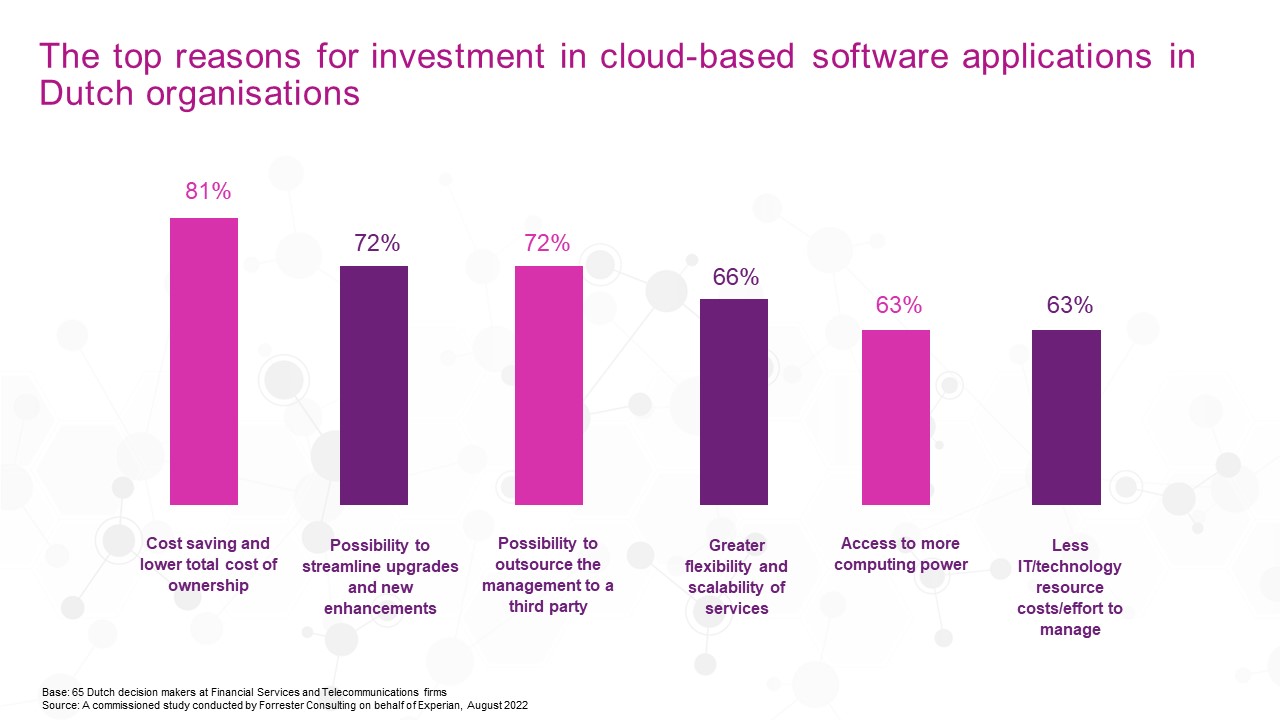

Cost reduction, streamlined upgrades and outsourcing management to a third party are driving cloud-based software adoption. Firms that have not adopted cloud-based software yet are concerned about the control they will have over cloud-based applications, the timescale for transition, and regulatory compliance.

Digitalisation

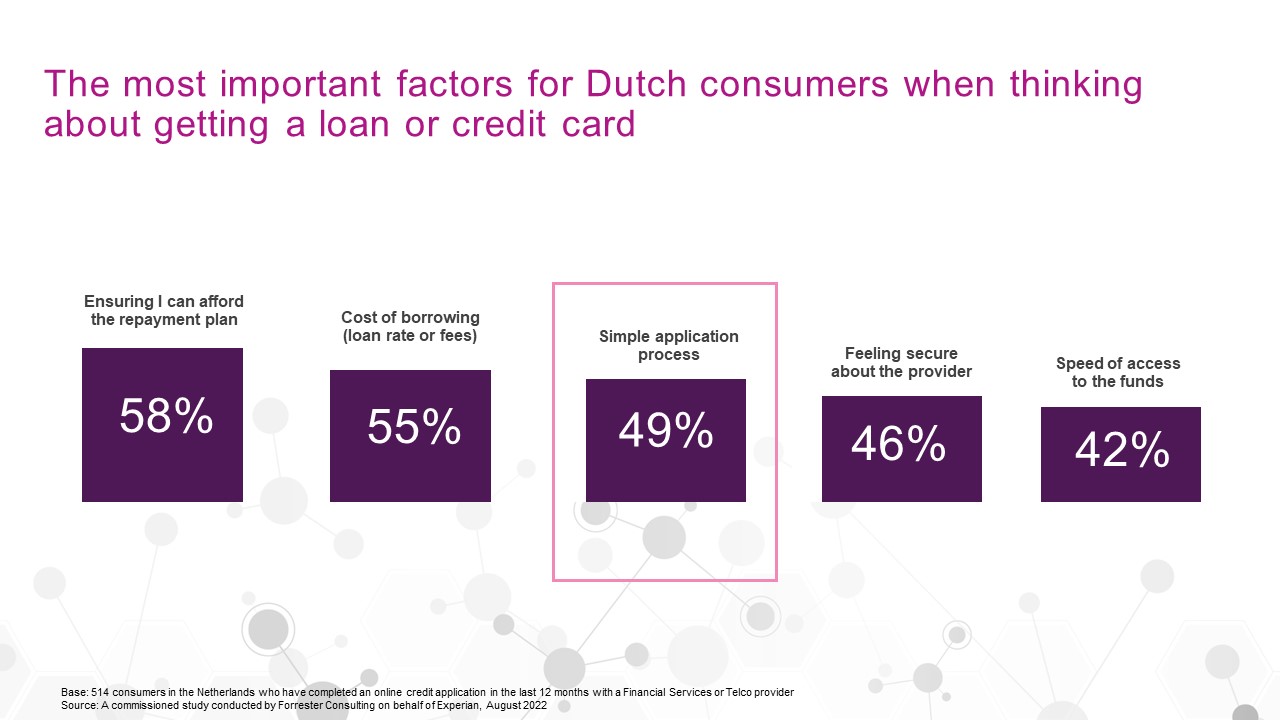

Dutch consumers are placing greater importance on simplicity. Our study shows that a simple application process is more important than the security of the loan provider and the speed of access to funds. They want speed and simplicity.

Business priorities and budget allocation

Adopting advanced analytics capabilities was the biggest priority over the next 12 months, with 80% of Dutch businesses indicating it as a critical or high priority. This highlights the importance of AI and ML to improve operational performance.

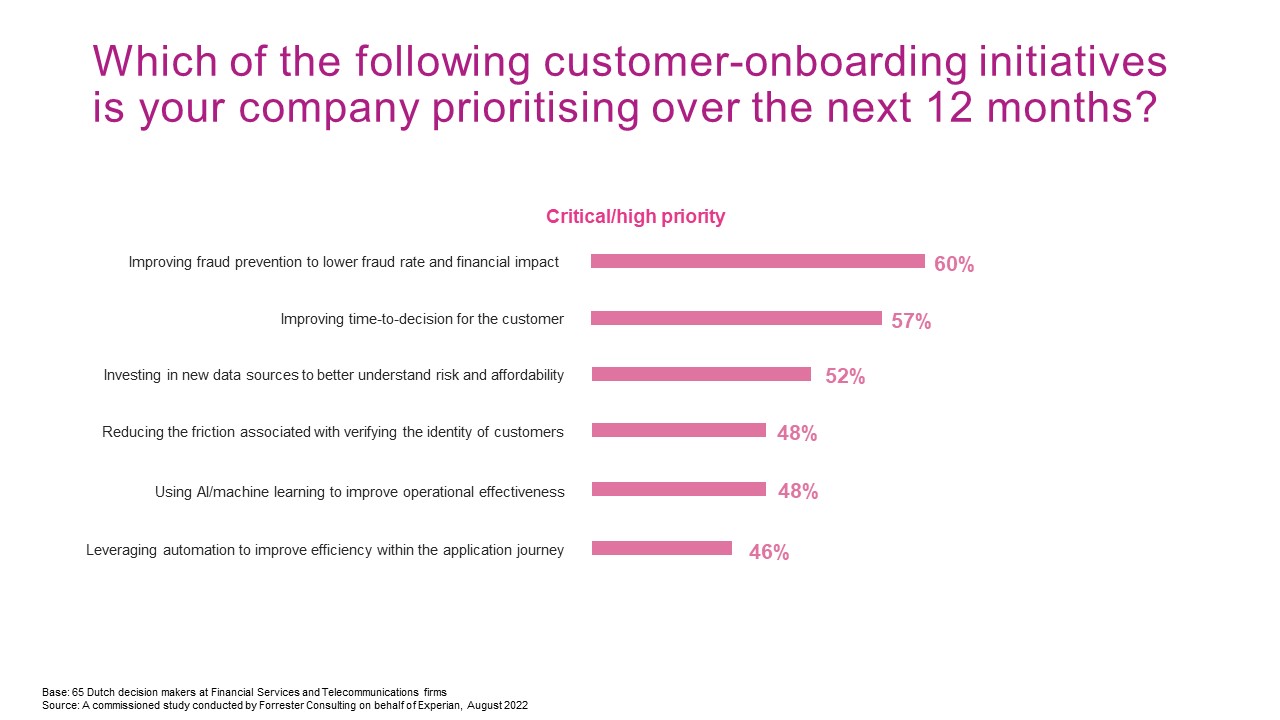

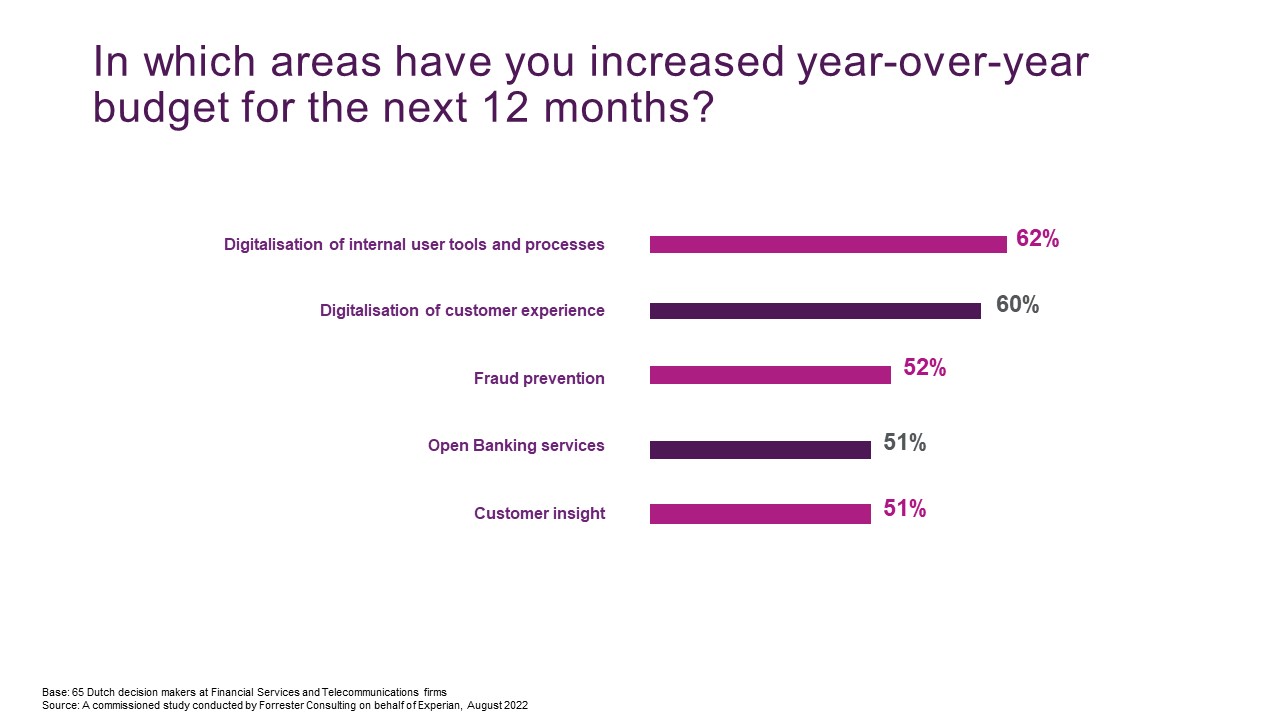

Dutch businesses see competitor threats (40%) and fraud (38%) as the biggest challenges to customer onboarding. Budget investment are being placed into digital tools and processes to help create a more efficient, digital-first customer experience.

Improving fraud prevention is a necessity, especially in an online world. But fighting fraud is not easy, and businesses are up against many challenges. The top challenges preventing businesses from successfully managing the costs and risks of increased fraud are increased delays and costs associated with referrals (46%), the difficulties associated with managing multiple types of fraud prevention software (31%), and an inability to rapidly adjust models, rules, and scores to respond to new fraud threats (26%). Firms will no doubt look for economies with comprehensive solutions that fight fraud solutions in multiple ways.