Thriday, a financial management platform for SMEs, has collaborated with Experian Digital to revolutionise financial administration for businesses. Thriday’s unique product automates banking, accounting, and tax for small businesses, helping them save time and costs. The integration of Experian Look Who’s Charging’s technology, which enriches and automatically categorises bank transactions in real-time, has enabled Thriday to offer its customers a more accurate and faster bookkeeping service than human labour. By charging users just $29.95 a month, Thriday has slashed the costs of financial administration for businesses while also saving them six hours of precious time each week.

See full story >Overview: ANZ transforms digital banking app

A world-leading collaboration between Experian Digital and ANZ for a global problem

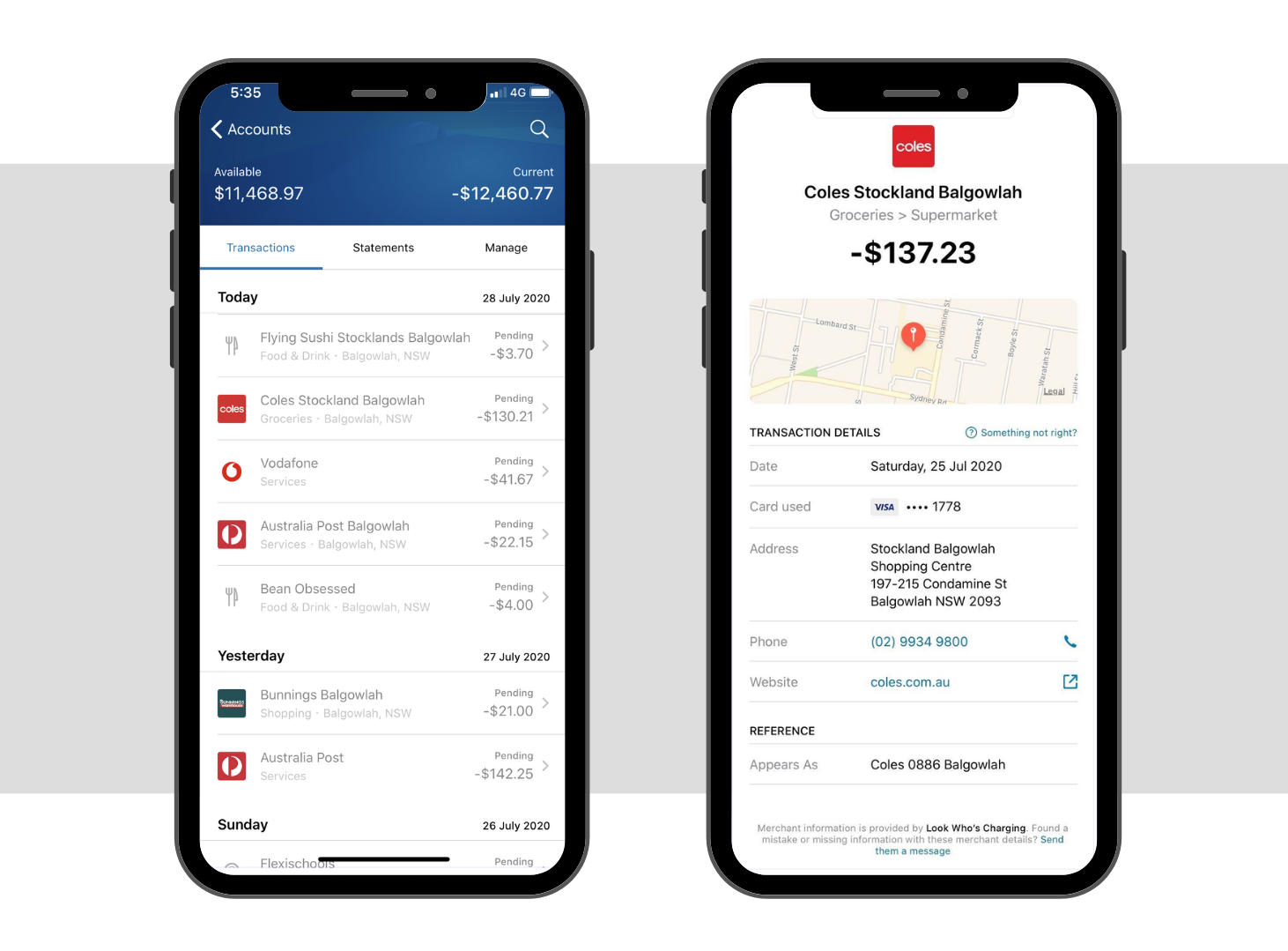

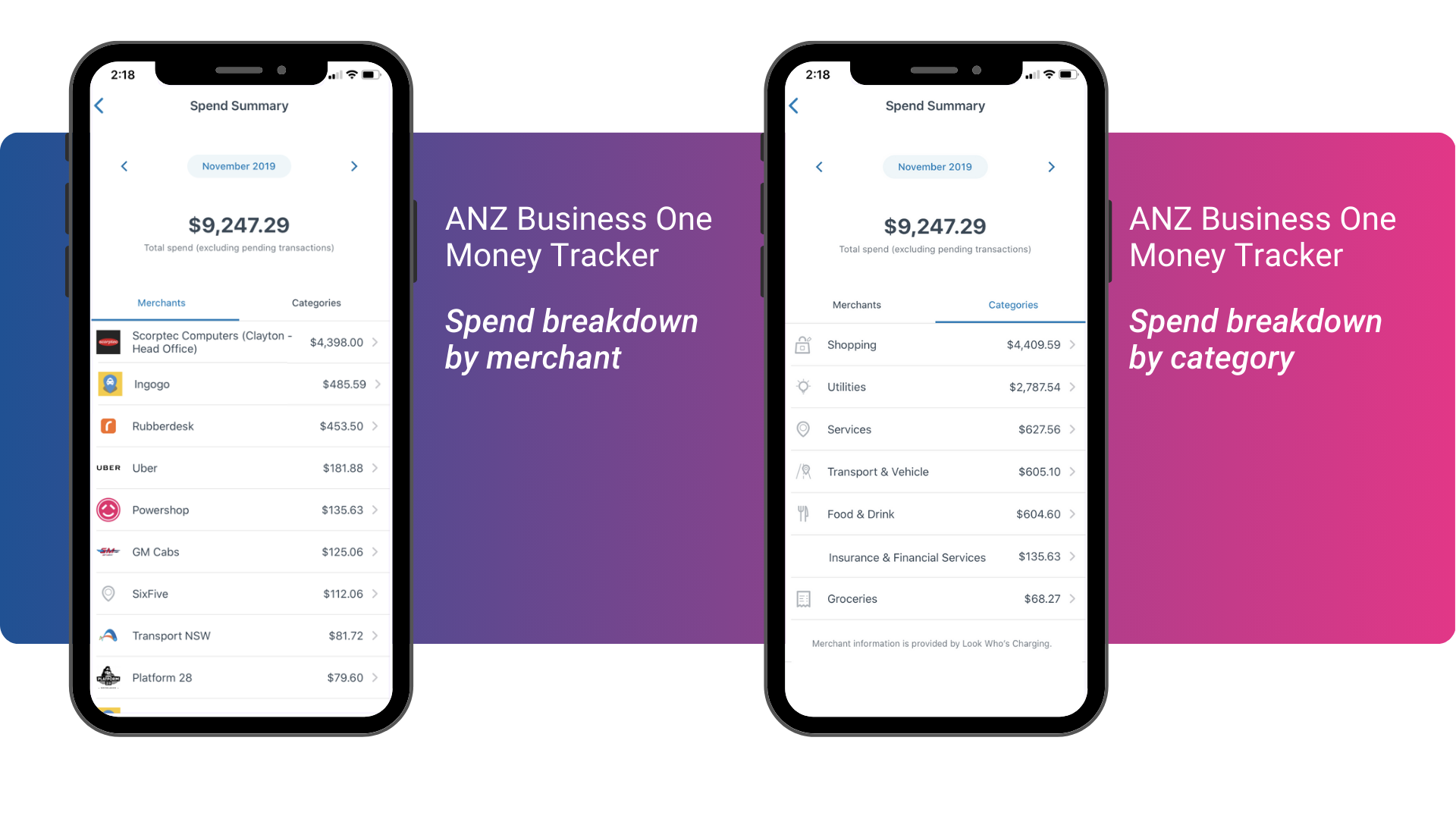

ANZ and Experian teamed up to tackle the challenge of confusing transaction descriptions on bank statements. ANZ customers faced difficulty identifying purchases, leading to increased calls and unnecessary card cancellations. Recognising this issue, ANZ leveraged Experian Digital, powered by Experian Look Who’s Charging. The technology replaced cryptic descriptions with recognisable merchant information including names, logos, maps and other contact details. This not only reduced call centre traffic but also an uplift in ANZ’s mobile app rankings. The collaboration exemplifies the success of self-service digital banking, enhancing the customer experience and allowing ANZ to focus on more valuable interactions.

Challenge overview

Often, bank statements can seem like they’re written in a different language. Merchant descriptions are unrecognisable, and the location of your purchase can often seem wrong.

For example, you buy some groceries from your local IGA store, and the transaction comes up as “VANS RETAIL GROUP PL.” For those trying to take control of their finances, it’s confusing – leaving everyday Australians and businesses with no idea where their money is going.

This has become a major customer problem. With a rapid shift in people transitioning away from cash, customer calls querying transaction descriptions have significantly increased. There are also often unnecessary card cancellations due to transactions looking unfamiliar, creating worry that they may be fraudulent, and causing inconvenience to the consumer as they have to change their recurring payments over to a new card.

Australia and New Zealand Banking Group (ANZ) is one of Australia’s largest banks. ANZ employs more than 39,000 people and provides banking and financial products and services to over 8.5 million retail and business customers. The bank operates across close to 30 markets.

| Industry: | Financial Services |

Solution overview

Enter Experian Digital

To solve the problem, ANZ decided to partner with award winning technology provider Experian Digital, powered by Experian Look Who’s Charging, to help rapidly deploy a solution in only five months to ANZ’s six million customers.

“We had identified the problem and set out to speed up the time it took from having a valuable idea to getting it in the hands of the customers. Experian Digital had this really innovative solution and they enabled us to provide real customer value in a relatively short time frame” said Justin Brown, Product Owner, Digital Innovation at ANZ.

By default, customers now see a company’s trading name and its logo instead of the previously displayed cryptic description. At the click of a button they can see further details such as location on a map and other contacts details like phone number, email address and website. This helps customers easily identify where a purchase was made and reduces unnecessary call centre traffic.

In the months following the integration, ANZ has experienced an uplift in its mobile application rankings, and was rated as one of the highest banking applications on both the App Store and Google Play1. In addition, ANZ won the 2020 Mobile Banking App of the Year award in Money Magazine’s annual Consumer Finance Awards. In a challenging year, improvements to the customer experience are invaluable.

Not a moment too soon

The sudden impact of COVID-19 heavily disrupted frontline staff in call centres globally, while at the same time customer queries with financial institutions increased substantially. The ability for customers to self-serve, utilising Experian Digital’s technology, couldn’t have come at a better time.

“Experian Digital has helped ANZ deliver an improved experience for our customers by making it much easier for them to recognise transactions on their statements and helping them to stay in control of their money. We’ve also seen fewer calls from customers trying to work out where specific transactions come from, and our analytics teams are able to cross-reference the Experian Digital data set, which helps us better understand customer needs.” – Jeff Mentiplay, Head of Australia Data at ANZ

The bigger picture

Self-service banking is the future in order to alleviate administrative pressure and to support customers who really need financial help. Already, the partnership between ANZ and Experian Digital has proven that customers are happier when they can answer their own questions, and at the same time bank resources are liberated to focus on more value-add customer conversations.

With the integration of Experian Digital complete, and the basic problem of understanding bank statements resolved, ANZ has the building blocks in place to embark on the next stages of its digital evolution and to remain at the forefront of digital banking.

1The ANZ mobile banking app has a rating of 4.7 out of 5 in the Apple App Store and 4.6 out of 5 in Google Play (as at 23 June 2020).

- Customers have instant clarity on what, where and how much they’re spending in real-time

- Helped to drive uplift in mobile application rankings

- Fewer customer calls to the ANZ call centre

Would you like more information?

Speak to an expert