Australians have a deeper winter sports heritage than many people realise. Australian Malcolm Milne was the first non-European to win a World Cup ski event in 1969, and the nation can boast a number of Olympic ski and snowboard medallists.

Today, Australia is home to 16 resorts that range from the small and cosy, up to a handful of super-resorts that cover hundreds of hectares.

In our latest consumer trends analysis article, we dive into which socio-demographic groups are most likely to visit Australia’s ski resorts and look at some of the reasons for their choice of destination.

If your organisation is directly involved in the Australian ski industry, then read on for a wealth of consumer insights. Visitors to the snow not only need to pick their accommodation and resort but need to equip themselves in the latest clothing (Ski’s, Boots or Boards) and determine their best mode of transport.

New South Wales

New South Wales is home to Australia’s highest snow fields and can boast the oldest (Kiandra) and largest resort (Perisher).

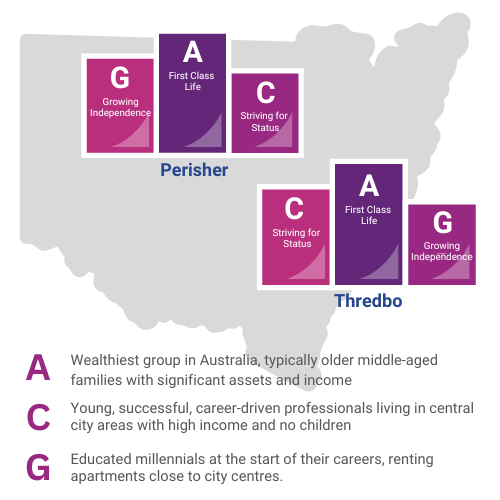

If we look at the two main resorts in New South Wales, Perisher and Thredbo, we find the dominant public audiences that visit are Mosaic Group A (First Class Life), Group G (Growing Independence) and Group C (Striving for Status).

Mosaic Group A is the wealthiest socio-demographic group in Australia and stand out as the dominant group for NSW resorts. Mosaic Group C and G are our youngest audiences, with Group C being the more affluent group.

Looking at the Thredbo resort, we find that more of Mosaic Group C visit than Group G. While the opposite is true for the Perisher resort. In addition, Mosaic Group A is more likely to visit Thredbo than Perisher.

We can see differences in profiles but why is this the case?

A key difference in resorts is economic in nature. A season pass for Perisher and surrounding resorts is $1,299. A similar pass at Thredbo can be significantly more at $1799. The profile of the Thredbo resort appears more attractive to our more affluent groups.

Other notable groups identified were Mosaic Group D (Secure Tranquillity) and Mosaic Group E (Family Fringes). Both affluent groups, clearly identifying visits to the snow as a pastime for families and those whose children have left home.

Victoria

Victoria has the largest number of resorts in Australia and can trace its heritage back to the 1860’s.

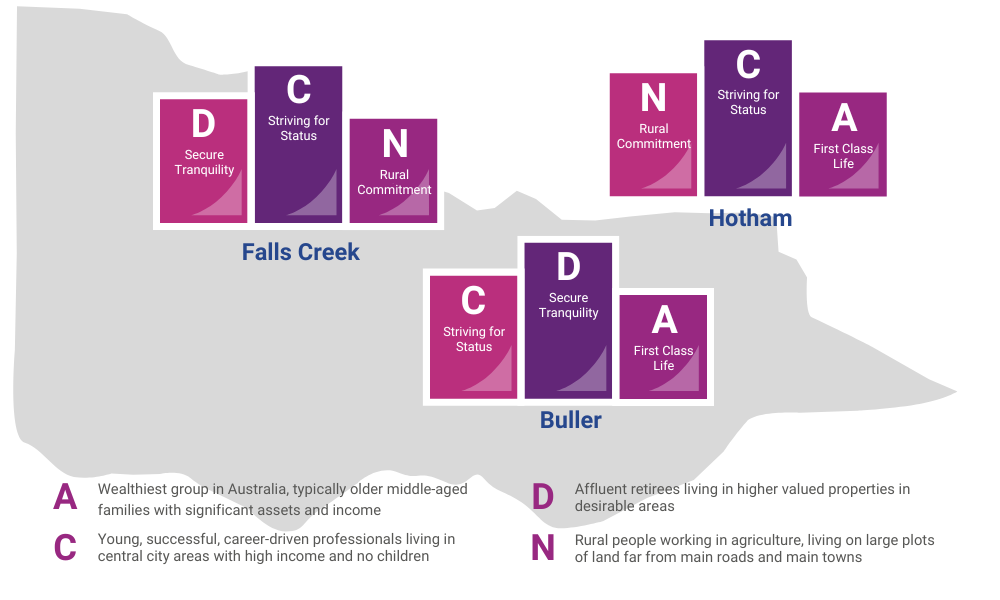

The three main resorts in Victoria are Falls Creek, Mt Hotham and Mt Buller. The three ski fields attract a similar audience to the resorts in New South Wales but with some subtle differences.

Mosaic Group A (First Class Life), Group C (Striving for Status), Group D (Secure Tranquillity), and Group N (Rural Commitment) are the most prevalent. Of these groups, Group C, our younger, affluent singles and couples, are most likely to visit Falls Creek and Mt Hotham. Meanwhile Group D, our older, empty nester audience, are most likely to visit Mt Buller.

We can see that in this case distance from the city, along with season pass options, could influence which audiences are more likely to visit each mountain. Mt Buller is the closest large resort to Melbourne, and we can see that as a result the older audiences such as Group D and Group A are more likely to visit this resort rather than Falls Creek and Mt Hotham.

Our younger couples/singles (Mosaic Group C and Group F, Establishing Roots) are more likely to visit the resorts of Mt Hotham and Falls Creek. These two mountains are close to double the distance from Melbourne than Mt Buller, however they both fall under the ‘Epic Pass’ season pass which appeals to younger crowds who are willing to drive the extra distance.

Understandably, school holidays also influence audiences at Victoria’s resorts. During the holidays we see a significant increase in Mosaic Group E (Family Fringes) and Group F (Establishing Roots) at Mt Hotham. Both these groups are family audiences with higher incomes, and Group F are typically earlier in their life stage and have younger children.

Finally, Mosaic Group N (Rural Commitment) are also prevalent at Victoria’s resorts and are nearly one and a half times more likely than the normal household to visit Mt Hotham and Falls Creek. This is not a trend shared with the resorts in New South Wales.

Australia’s Smaller Ski Fields and bordering States

The smaller ski fields in Australia consist of Mount Baw Baw, Lake Mountain and Lake Buffalo in Victoria, and the Selwyn Snowfields in New South Wales.

These resorts are typically cheaper and more family friendly due to the smaller size and ease of use. As a result, they tend to attract the less affluent Mosaic groups. Mt Buffalo, for example, has a higher propensity to see visits from family groups, such as Group F (Establishing Roots), while Mt Baw Baw has higher numbers of Group G (Growing Independence).

If you are a Queensland resident and you like to hit the snow then you’ll need to hop on a plane. 65% of people from Queensland choose New South Wales. Conversely, if you are from Western Australia then you have a preference for Victoria.

Why this matters

Consumer spending patterns are changing. While we can see a visit to the snow is skewed towards the wealthier segments, it’s evident that these groups are also looking for cheaper alternatives with the rising cost of living. Someone who used to buy premium ski gear may now be content with more budget conscious gear from brands such as Aldi, Decathlon and Anaconda. A person who enjoyed Thredbo, may now prefer the saving that can be seen by purchasing a Vail Resorts Epic Pass. Lastly the same can be said for accommodation (mid-range Vs premium) and transport (A Greyhound Bus Vs a hired car).

If your business is directly involved in the Australian ski industry then come and talk to us today and we can help you model who your “best” customers are, and then help you discover similar audiences across a vast online and offline network.

Delivering the right message, right offer, right time is now more important than ever.

How did we perform this analysis?

The insights presented in our Consumer Analysis series of articles are all created using Experian’s award-winning consumer segmentation tool, Mosaic. The tool provides a unique view of Australia, by analysing the behaviours and characteristics of the adult population and providing data insights across 99% of households.

The information Mosaic gives to organisations helps them to acquire new customers, retain their “best” customers, and understand Australian consumers both online & offline. This comprehensive proprietary database comprises over 1000 demographic, socio-economic and behavioural characteristics.