Advanced Analytics is therefore a big area of focus for businesses, leading to increased investment in Artificial Intelligence (AI), and specifically within decisioning, the use of Machine Learning (ML) to improve the effectiveness of models and decisions for creditworthiness, affordability, fraud, early warnings, and collections. There are significant operational performance improvements that can be realised with the use of Machine Learning, ultimately leading to increased profit.

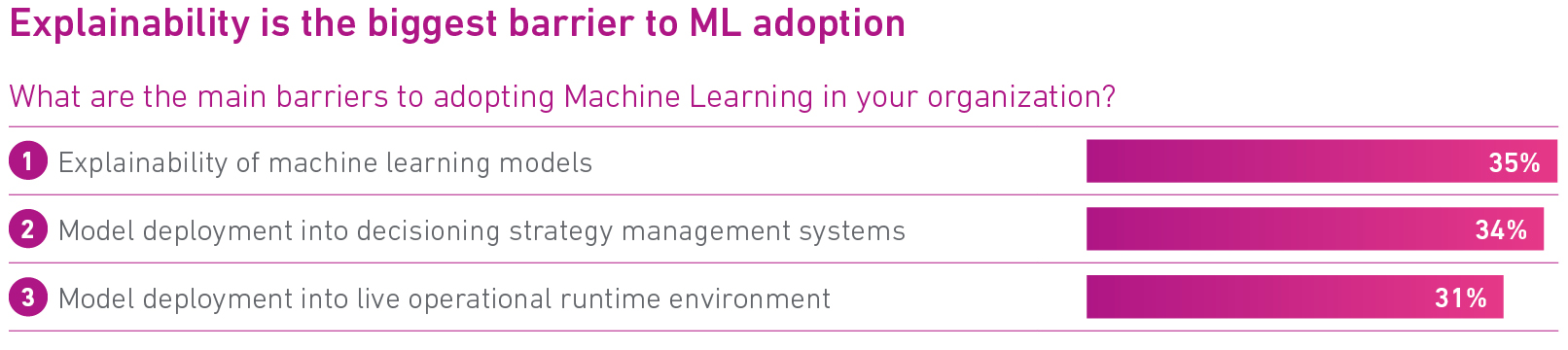

We’ve developed a report, ‘Explainability: ML and AI in credit decisioning’ to help clients understand the value that ML can deliver to decisioning and how it can improve existing performance KPIs. Importantly, the report will discuss the critical role that ‘explainability’ plays in maximising the use of Machine Learning. If you want to benefit from ML you must understand explainability. The report covers how explainability is achieved and why it is important for any ML based model to be supported by explainable results.

What you’ll find in the report:

- Part 1: Why ML models will become the new normal

- Part 2: Why Explainability is the key to unlocking the ML potential

- Part 3: 5 tips for implementing ML with Explainability