Machine Learning models can unlock the ability to deliver predictive models with enhanced predictive power for creditworthiness, affordability, and fraud assessments.

Businesses that are not using or planning to use Machine Learning (ML) based models are leaving money on the table. The question is: why?

Experian’s new report, Explainability: ML and AI in credit decisioning, discusses how Machine Learning improves the accuracy and effectiveness of models, leading to a more accurate assessment of ‘good’ and ‘bad’ customers.

This translates to greater revenue and lower operational costs. But any business using Machine Learning-based models must ensure they are fully explainable. Otherwise, they risk fines and possible reputational damage.

Machine Learning is capturing the attention of businesses

Businesses recognise the advantages that AI can bring, with 66% believing that Advanced Analytics, including Machine Learning and Artificial Intelligence, will radically change the way they do business.

It is, therefore, no surprise that 66% of businesses state that adopting Advanced Analytics capabilities is a top business priority over the next 12 months.

The challenge is to unlock the potential of Machine Learning while creating a structured methodology that allows full transparency of model creation and decision output.

Increased model predictiveness

One of the biggest benefits of Machine Learning is improving the predictiveness of models.

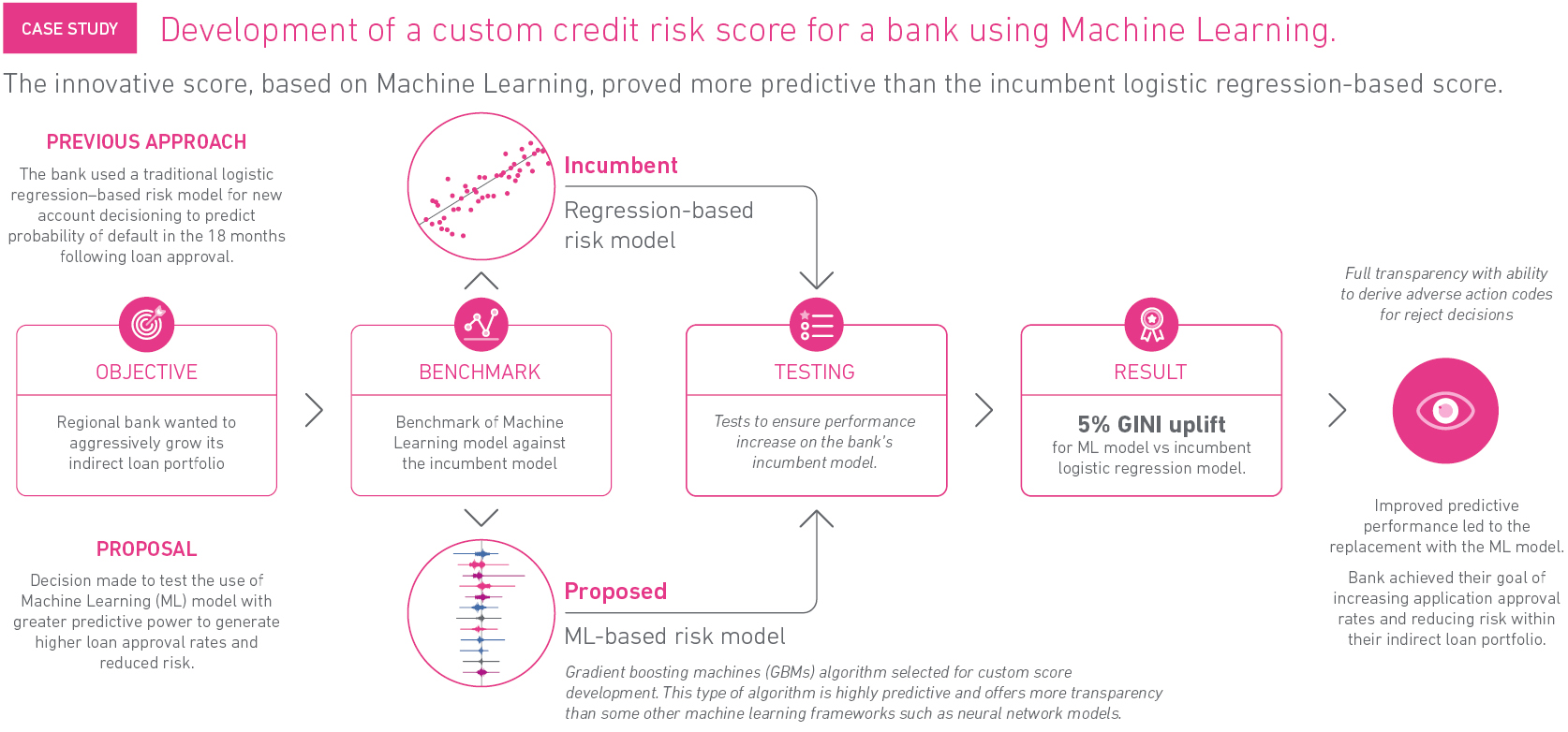

The adoption of Machine Learning can increase the GINI coefficient, which is used to assess the effectiveness of credit risk models, to an average level of 20% relative to existing non-ML models. The more predictive or accurate the models, the more profit is delivered through a better assessment of credit risk.

The availability of new data sources, combined with the power of cloud computing, is making the use of Machine Learning even more attractive for progressive organisations.

The performance of ML models tends to improve when more data is available to train the model.

From a credit risk perspective, the use of Advanced Analytics to consume and analyse vast amounts of data has meant that businesses can incorporate more data sources and variables into their decisioning logic.

A good example of this is the use of transactional data from Open Banking, which provides much more depth of information for credit risk modelling.

Machine Learning is used to categorise the transactional data into different categories of income and expenditure so it can be easily ingested into the modelling phase, where ML can be used again to develop a custom score.

As a result, ML can use alternative data to identify customers that previously may have been considered “thin-file” – opening the door to more customers while supporting greater financial inclusion.

ML can drive more predictive decisions by analysing large volumes of data – both structured and unstructured – as well as non-linear relationships in the data in a very short period of time.

And, because of the improved model performance, some organisations are entrusting ML models to deliver increased automation within their decisioning.

This drives down operational costs but also enables faster time to decision for customers because ML helps reduce the volume of back-office checks.

Barriers to ML adoption

Despite the value Machine Learning models can deliver to performance, many businesses are yet to deploy these models within their business.

In Experian’s recent research conducted with Forrester Consulting, lack of explainability was the biggest barrier to Machine Learning adoption.

Given the use of Machine Learning is still in its early stages for credit decisioning, there is trepidation around the implementation of ML-based models.

In addition to concerns around providing the necessary explainability, businesses are also concerned about the lack of internal knowledge and expertise in this area.

Again, our Forrester research identified that, aside from the COVID-19 pandemic, lack of expertise and technology infrastructure to incorporate machine learning and big data (32%) was one of the biggest overall challenges prohibiting businesses from achieving their top initiatives.

This lack of expertise has meant that only around half of the projects involving AI end up being put into production, as highlighted by Gartner’s research.

Businesses must take advantage of the tools that allow them to ingest, map and deploy ML models without the need to invest heavily in data scientists and developers.