A deep dive into PEPs and sanctions screening compliance

Sanctions and Politically Exposed Persons (PEPs) watchlists are constantly changing as the geopolitical environment evolves. The challenges involved with screening potential clients and business partners against these lists are considerable – especially since there are thousands of lists worldwide.

At the same time, the consequences of unknowingly conducting business with a sanctioned individual or organisation are severe. These can include substantial fines issued by regulatory bodies, exclusion from trading in certain markets, and significant damage to your reputation and credibility.

The intention of this guide is to help you navigate this challenging process by highlighting key issues involved with PEPs and sanctions screening and how they can be avoided. The insights are provided by one of Experian’s top experts in this field: Sarah McCallum.

For a summary of this topic, we invite you to watch the interview below.

What are the biggest challenges when conducting sanctions and PEPs screening?

The three main challenges involved with the sanctions and PEPs screening process are as follows:

- Ensuring that the checks you carry out are sufficiently robust to comply with the regulators, both at the point of application and then throughout the customer lifecycle

- Making sure that you are keeping up to date with the latest versions of the sanctions and PEPs lists

- Maintaining a consolidated view of all the relevant lists

How can you ensure the sanctions and PEPs data you are checking is the most up-to-date information?

This is particularly challenging for organisations that compile the lists and conduct these checks in-house, as the only way to verify that the information they are using is up to date is to manually cross-reference each data source on a daily basis.

However, with the help of third-party service providers – that consolidate all the relevant sanctions and PEPs lists – it is much easier to ensure that the lists you are using to conduct checks are accurate and constantly kept up to date with the most recent changes.

What is the best way to deal with name variations and data inaccuracies?

The most effective way to avoid these issues is to use a technique known as fuzzy matching. This can be applied to every check to ensure that variations such as an inverted forename and surname, or people that use their middle name as their first name, are flagged and the correct person is identified.

By using this method, it is also possible to check for common spelling variations. For example, Sarah is often spelt as Sara, and there are many other subtle variations that are often missed with direct matching, such as Jayne/Jane and Mohammed/Mohammad.

How can PEPs and sanctions screening be incorporated into identity and fraud checks?

With the right software solutions, it is simple to carry out PEPs and sanctions checks as part of your identity and fraud screening process during onboarding. These checks can be integrated with other identity checks – such as document verification – to ensure that you have a comprehensive and holistic view of the individual.

Are you looking to improve your PEPs and sanction screening process?

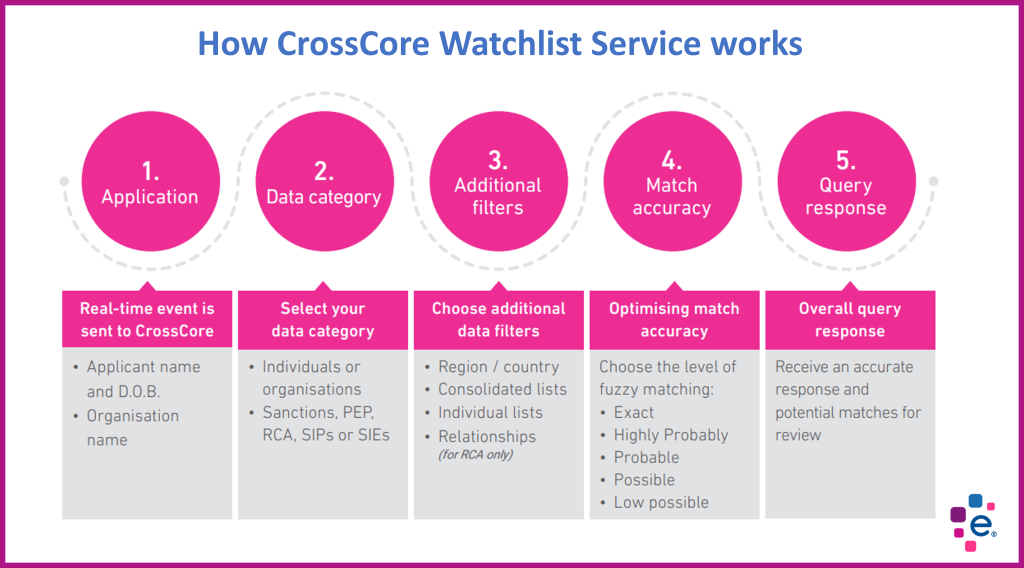

Experian can help you navigate this complex and constantly evolving process with our simple and reliable solution called CrossCore Watchlist Service. It provides real-time screening across a comprehensive global database of PEPs and sanctions lists with a simple integration into your onboarding system.

CrossCore allows you to connect and orchestrate multiple fraud services within a single platform, and with the addition of our Watchlist Service, you can proactively manage risk within a unified fraud-and-anti-money-laundering (FRAML) framework.

For more information about CrossCore Watchlist Service, simply fill out the form below, and we will send you the brochure with a detailed breakdown of the benefits the solution provides and how it works.