Trended attributes: unlocking hidden insights

Although traditional credit bureau scores provide valuable information about a consumer or SME’s financial situation, they can be limited by being point-in-time insights.

In comparison, trended attributes look at the patterns in credit behaviour over a period of time. By analysing credit usage and repayment patterns over a two-year period, lenders can identify if their customer’s financial circumstances are improving or deteriorating.

These historical trends can be used to more accurately predict whether a customer is likely to repay their loan. Aggregating these data points and combining them as ratios in plug-and-play attributes can improve the accuracy of lending models by up to 20%.

This article explains what trended attributes are and why they are such powerful predictive tools in credit risk assessment. Given the rapid pace of change in the lending environment over the past few years, trended attributes are becoming increasingly important to making profitable and responsible lending decisions.

Download our attribute PDF - Precision Decisions: Unlocking the value of attributes

DownloadHow do trended attributes simplify analysis?

All of the data points used to develop attributes can be found in standard credit reports. However, in order for lenders to understand the trends hidden in 24 months of trade data, they need to be able to analyse an enormous amount of data.

To illustrate this, let’s consider the following example. Imagine a single consumer with ten trades on file, over a period of two years this means there are at least 1,200 data points to analyse. Now, if you multiply that by a conservative portfolio of 100,000 customers, that means you will need to analyse over 120 million data points. This requires considerable resources and analytical ability, which not all lenders have the capacity for.

Another point to consider is that if this trended data is used to assess creditworthiness in the underwriting process, then it may well be the reason why a customer is declined a loan. In this case, the lender will need to create a set of adverse action reason codes to understand this decision and communicate it to the customer.

Rather than go through all that effort, lenders can access a library of thousands of highly predictive and industry-specific trended attributes from Experian. These can be used to develop new models or used for segmentation overlays. This means you could be enjoying the benefits of trended attributes in only a few weeks.

What insights can trended attributes reveal?

By understanding the financial trajectory of a customer over time, trended attributes can show lenders if their customer’s financial situation is trending up or down. This allows for a much more accurate prediction of future behaviour than only looking at a moment-in-time credit score.

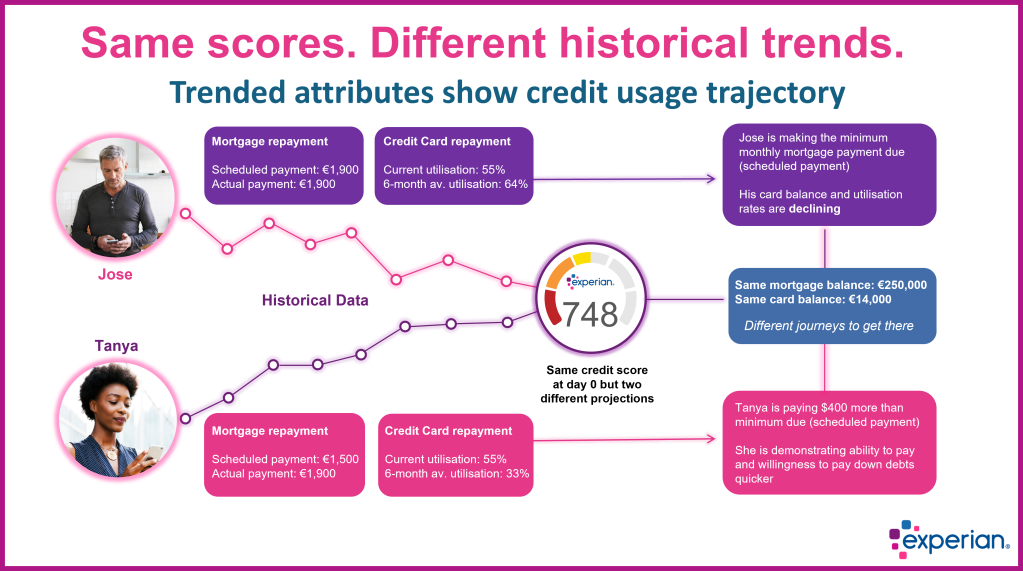

The image below shows how a credit score alone can be misleading, using two example consumers to show why changes in balance over time can reveal a much better understanding of each borrower’s financial situation. Both Jose and Tanya have the same credit score but very different journeys to get there. Which one represents the greatest risk going forward?

The following points illustrate some of the insights that trended attributes can provide:

- Changes in balance – analysing a customer’s balance over time shows if the amount they are borrowing is decreasing, remaining steady or increasing.

- Credit utilisation rate – a customer’s credit utilisation ratio, which represents the amount of credit they have used compared to their maximum credit limit, is a useful metric to understand whether their financial situation is improving.

- Payment patterns – historical repayment behaviour shows if a customer normally makes monthly payments on time and if they have missed any payments. It can also reveal if the frequency of late payments is increasing or decreasing.

- Outstanding debt level – how much a customer’s overall debt position has changed over time is essential to understand if they are accumulating debt or actively paying down their debt.

An example of how these subtle changes in borrower behaviour can have a large impact on risk assessment is monthly repayment trends. If the borrower is shifting from paying down their debt aggressively to only making the minimum repayment, then they could represent a higher-risk lending option. Including this level of granular detail is important in terms of understanding credit risk.

These changes in a potential or existing customer’s repayment rates and debt burden are not reflected in a traditional credit score, yet they are powerful indicators that can significantly improve the accuracy of lending decisions.

Download our attribute PDF - Precision Decisions: Unlocking the value of attributes

DownloadWhat are the benefits of using trended attributes?

By analysing the financial history of potential and existing customers, you can make better lending decisions – both at originations and across the customer lifecycle. This can lead to greater revenue without an increase in risk exposure.

Trended attributes can also improve your ability to provide inclusive financial services by recognising positive credit behaviour.

Here is a breakdown of the benefits that trended attributes can provide at each stage of the lifecycle:

Prospecting

- Identify which potential customers will be the most profitable by understanding their debt burden and capacity to repay.

Originations and onboarding

- Enhance the accuracy of your decisioning models with a comprehensive evaluation of the customers’ historical credit behaviour.

- Expand new customer eligibility without increasing your risk levels.

- Improve customer experience by reducing the time required to assess creditworthiness with automated decision-making.

Customer management

- Improve the accuracy of customer segmentation by using an attribute overlay to classify customers with greater precision.

- Identify cross-sell and up-sell opportunities with the right products and terms to increase your response rates and reduce customer attrition.

Pre-collections and collections

- Improve your ability to identify and proactively manage financially stressed customers.

- Increase collections predictability and effectiveness by prioritising customers with the capacity to pay.

Are you interested in using trended attributes?

If your business is interested in taking advantage of trended attributes, then contact us today. We can help you identify the most predictive trended attributes for your type of lending and industry. You can benefit from our decades of experience developing and integrating trended attributes across the consumer credit lifecycle.

Experian has been creating best-in-class attributes since 1976, and we have developed thousands of attributes since then. Our attributes use both local and global datasets to summarise consumer and SME credit behaviour in granular detail. You can use our attributes to support a wide variety of modelling and analytical opportunities that enable better decisioning and segmentation.

For more information about our attributes, speak to your local Experian representative or download our Precision Decisions: Unlocking the value of attributes PDF guide.