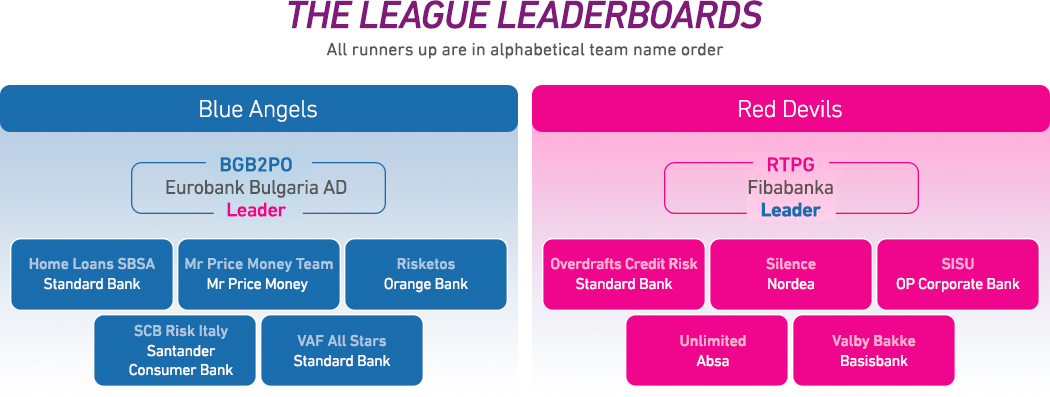

In the weeks to come the participants will compete with fellow professionals from across Europe, to compete for the title Best EMEA Credit Department of the year – Sim Risk 2020 Winter Edition. The first two rounds has been completed and teams are currently going head-to-head with a close race between the teams in the leagues.

In the next Round the mission will be to maximise profit while minimising expected losses for a new credit card portfolio in line with IFRS9 requirements. Round Three has been developed around the Experian award-winning platform, Ascend, and you will play with the IFRS9 module with the assistance of one of Experian’s Senior Analytics consultants.

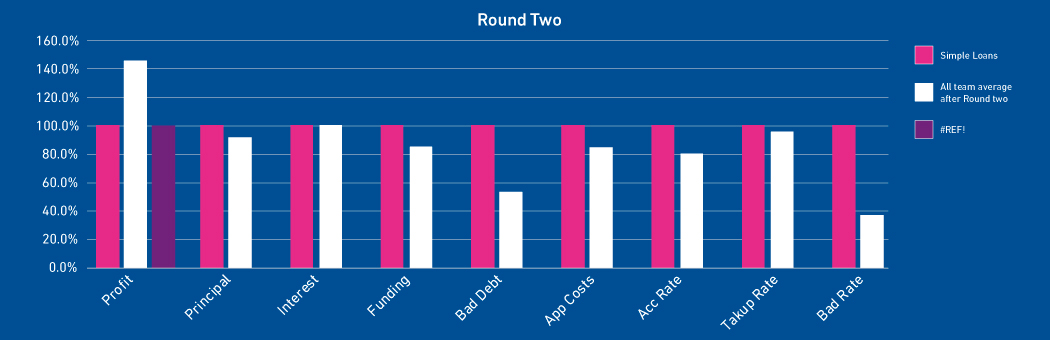

Below is a summary of the results (averages from across all teams) achieved with the second set of strategy changes, measured against the Simple Loan challenger (benchmark).

We wish all the teams a Merry Christmas

and

all the very best for Round Three – we look forward to seeing the list of finalists!

Team SISU: OP Corporate Bank

Some thoughts from Team SISU and their Team Captain; Teemu Muukkonen, Senior Credit Strategist at OP Corporate Bank.

“OP Corporate Bank plc” is part of “OP Financial Group”, the leading financial services group in Finland. “OP Corporate Bank plc” provides its corporate and institutional customers with a diverse range of banking, non-life insurance and asset management services, and private individuals with an extensive range of non-life insurance and private banking services.

Teemu shared some thoughts on behalf of her team based on their experience from the second round.

“Personally I have participated a workshop/demo session some years ago where I have seen a similar demonstration of Assisted Design tool. When registering for the competition we were expecting toto have fun and at the same time learn more of Experian products.

Other members of our team have not seen Assisted Design demo tool earlier and I think they didn’t know what to expect.

The program have exceed our expectations. This have been very fun way to learn more of Experian tools and also easy way to show the tools what we are using to a members in our organization who are not using Experian tools.

The remote sessions have been very successful and well organized. The instructions, the driver and communication internally have worked almost as smooth as it would be on the onsite meeting, I think.

The best thing about the competition have been so far the fun way to expand knowledge of the tools in our organization, teamwork in a fun way and also a good results in the game 😊

Our secret for the good results in the game have been the concentration to bad debts and credit risk levels. Even the customer data and customer behavior have not met all our expectations, the tool (assisted design) have helped us to find the most risky segments. To analyze the data and focus on the risk levels and profitability is something that we are doing daily, so the approach for the game was quite natural for us”