As digital adoption continues to expand into every aspect of our lives so too does the threat of cybercrime. According to INTERPOL’s Global Crime Trend report, financial cybercrime is the biggest crime threat worldwide with 70% of global law-enforcement respondents expecting online attacks to increase in the future.

This precipitous increase in cybercrime is closely associated with fraud and is forcing online merchants and service providers to re-evaluate their fraud prevention solutions. The sophistication of modern fraud threats means that traditional rules-based systems struggle to adapt to this constantly evolving landscape. Moreover, they often block a significant proportion of genuine customers by misidentifying them as suspected fraudsters.

The combined effect of these two factors – fraud and false declines – can have a considerable impact on revenue. So how can businesses find the right balance between detecting fraud while still providing real customers with a simple checkout or onboarding process?

The most effective way is to utilise the power of Artificial Intelligence (AI). By using an ensemble of AI-driven Machine Learning, device intelligence, and unambiguous rules, businesses can accurately identify fraud while simultaneously reducing false positives. This article investigates how this technology enables online businesses to combat fraud while safely growing revenue.

What’s the best fraud solution for digital retailers and credit providers?

Although fraud has always been a challenge for online businesses the recent surge in both the volume and complexity of fraud cases has shifted business priorities. According to Experian’s latest Business and Consumer research, investing in fraud prevention was the top business priority in 2022. This indicates that many companies are looking for solutions to combat fraud – but where should they focus this investment to achieve the best results?

One of the most commonly used fraud prevention solutions is two-factor authentication. This has become a global standard over the past decade and is becoming increasingly outdated. Depending on the type of two-factor verification used the security code is vulnerable to interception. Another major flaw is the rise in account takeover fraud – where fraudsters gain access to login details for multiple user accounts and thus circumvent authentication verification.

The use of payment or application process rules is another common fraud prevention solution. These require a skilled team of fraud specialists to reverse engineer fraud cases and manually create rules. The biggest problem with rules-based systems is that they become cumbersome and end up blocking a significant percentage of legitimate customers. This increase in false declines not only impacts revenue with a loss in sales but also damages a brand’s reputation.

Fortunately, there is a way for businesses to avoid these issues and stay ahead of fraud while still providing a smooth customer experience. The best fraud solutions combine Machine Learning with unambiguous rules and device profiling. This allows businesses to automatically classify each transaction with far greater accuracy and reliability than other fraud prevention systems.

Why Machine Learning is the best fraud solution

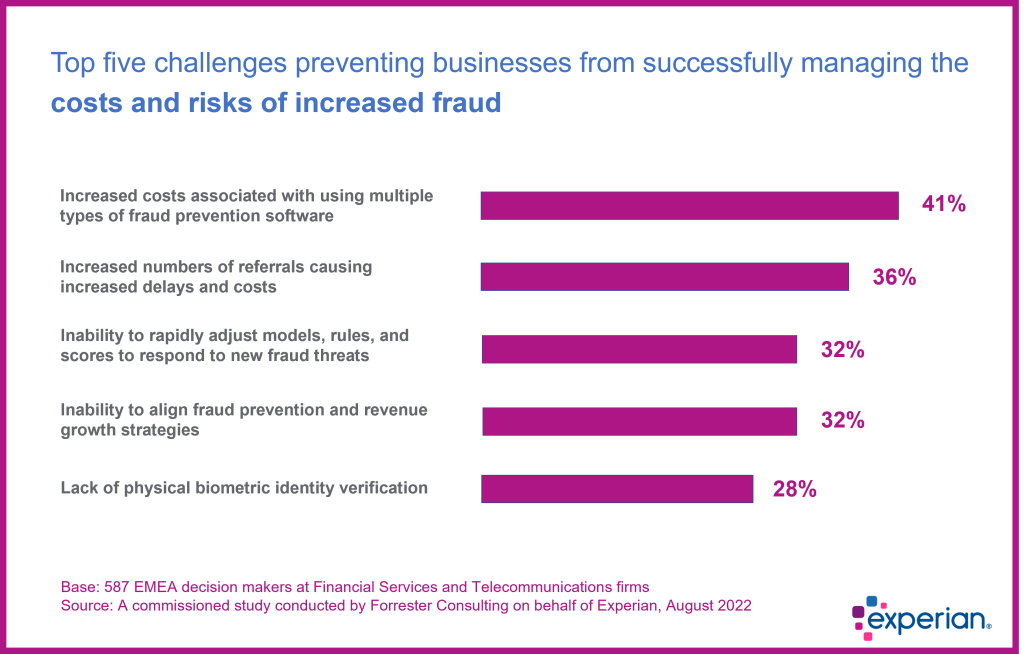

To understand why Machine Learning is the key component of any modern fraud system it is useful to consider the biggest challenges preventing businesses from successfully managing the costs and risks of fraud.

The right AI fraud prevention solution can directly address these challenges:

- By combining a Machine Learning model, device profiling data, and pre-configured rules, top fraud prevention software allows businesses to use a single platform for fraud detection. This reduces costs and simplifies fraud case management.

- Fraud is evolving every day. The only way to respond to this threat is by using AI and regularly re-training your Machine Learning model with new fraud cases. The advantage of advanced analytics is that it can learn new fraud patterns quickly, so businesses can take action before their fraud losses spiral out of control.

- The increased accuracy of AI fraud prevention means far fewer cases need manual reviews. This lowers your fraud agents’ workload and every case they review can be added to the model, so it constantly becomes more precise.

- AI fraud prevention is the best way to reduce fraud rates while also decreasing the number of false declines. This helps balance revenue growth with fraud prevention strategies.

Unlike rules-based fraud prevention, the performance of a Machine Learning model improves with more data. The larger the data set used to train the model the more accurate the model will become. Another benefit of Machine Learning is the ability to find correlations and patterns in data that are not immediately apparent to a human fraud specialist. This capacity – to identify trends and underlying associations – is one of the main reasons why AI outperforms any other type of fraud solution.

Pros and cons of AI fraud prevention

It’s clear that Machine Learning models have the potential to improve the effectiveness of fraud detection for online businesses. Let’s take a closer look at how they can also help grow revenue and some of the other advantages they can provide.

Benefits of AI fraud prevention software:

- Fewer false declines – with increased accuracy in identifying both fraudsters and bonafide customers

- Faster detection – automated AI systems process data in real-time and almost instantly classify transactions, this improves the customer experience and alerts you to fraud threats immediately

- Reduce costs – with fewer referrals and a single fraud platform

- Scalability – manage long-term growth and high-sales events without the need for additional fraud agents

- Constantly adapt – identify and respond to fraud trends as they happen by retraining the model with each new fraud case

- Lower chargeback rates – detect the subtle signals that indicate chargeback fraud and block these transactions before they occur

- No downtime – unlike human fraud agents AI can constantly monitor and analyse sales

As with any new technology, there are a number of important considerations to take into account before implementing a Machine Learning fraud solution. These factors can greatly reduce the effectiveness of any AI model and as regulations governing the use of AI are introduced, failure to comply with these laws will soon result in prosecution and fines.

Let’s break down each one of the challenges involved with implementing AI fraud prevention:

- Explainability – it is vital to ensure that all Machine Learning models are fully transparent so that every decision can be explained to customers and regulators

- Data Quality – to achieve high levels of accuracy the model needs to be trained with a sufficient volume of clean data, otherwise it will be prone to errors

- Bias – any prejudice must be removed from the data before the model is trained otherwise the model will continue to exhibit these features and deliver a higher false positive rate

- Privacy – processing sensitive data is strictly regulated in many regions and companies must adhere to the applicable data privacy regulations

- IT complexity – negotiating the IT and legal requirements involved with setting up an AI fraud system is a specialised skill set that is outside of many businesses’ capabilities

The easiest way to avoid these challenges is for businesses to partner with experienced suppliers that have a history of working with Artificial Intelligence and the associated compliance considerations.

Is your business looking to improve fraud detection?

The threat of online fraud is only going to increase as digital adoption becomes more widespread. To overcome this challenge businesses need to take advantage of AI fraud prevention technology – by incorporating the power of Machine Learning with device intelligence data and some essential fraud rules.

As a leading global supplier of fraud prevention solutions, Experian has the experience and expertise to help your business through each stage of establishing and maintaining a fraud solution specifically tailored to your requirements. If you would like more information, we invite you to download our extensive Machine Learning Fraud Prevention Guide or contact us to speak to your local consultant.