For online businesses to successfully manage the increasing threat of fraud they need a solution that does more than simply reduce their fraud rates. Although this is the primary role of any fraud prevention system, it needs to happen in conjunction with fewer false declines and a smooth customer experience to be truly effective.

More than half (57%) of the business leaders in our latest research stated that finding the right balance between increasing revenue and reducing fraud losses is challenging. The combination of false positives and a complicated checkout or application process can cost more than actual fraud losses. Especially when businesses are relying on manual rules-based fraud prevention systems.

These systems have become outdated with the advent of AI-driven Machine Learning algorithms. By combing AI fraud detection with flexible rules, businesses can automatically classify transactions with unprecedented accuracy and differentiate between genuine customers and fraudsters without impacting the customer journey.

This article explores why false positives have become such a considerable problem for online merchants and explains how Machine Learning provides a powerful solution to this issue.

What are false declines vs. false positives in fraud prevention?

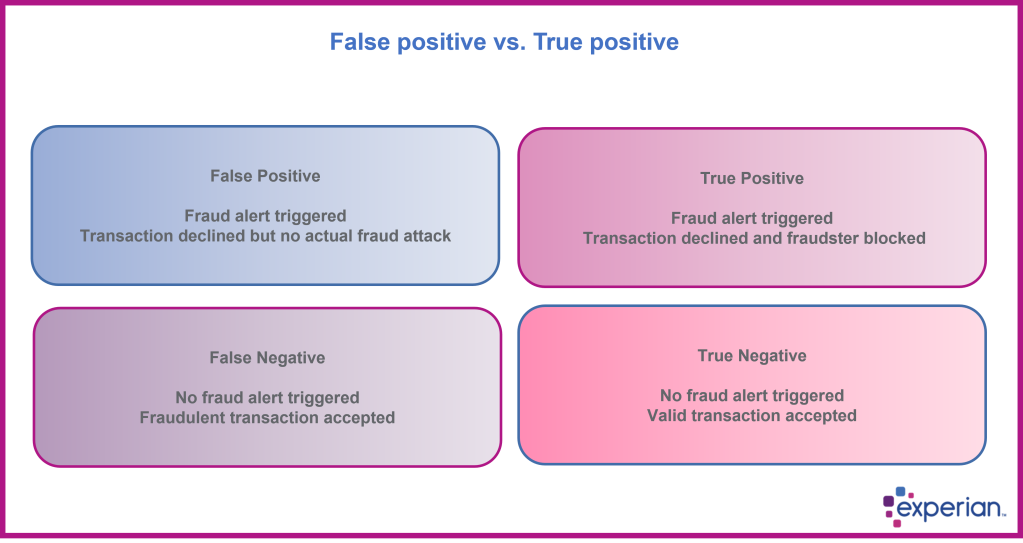

These two terms are often used interchangeably, however – there is a subtle difference between them. False declines are a category of false positives that are specifically associated with payments. This is when a legitimate customer is prevented from making payment at the checkout stage of their purchase. Their transaction is incorrectly identified as fraudulent and therefore blocked.

In contrast, false positives are a more general term that also includes all the other stages involved with a purchase or application, such as opening a new account or authorizing an existing one. In this situation, a legitimate customer is erroneously identified as a suspected fraudster and blocked before they even reach the checkout stage.

False positives are usually caused by rigid rules-based fraud prevention systems that incorrectly classify bonafide customers as fraudsters. As fraud has become more sophisticated these yes-no binary rules become overly convoluted as they attempt to cover a wide range of different fraud techniques. Only a small percentage of false positives occur during manual reviews when fraud agents are unable to decide whether a transaction is legitimate or not.

Machine Learning models are also susceptible to false positives – if they are not properly trained initially and then regularly retrained. The algorithms used in fraud detection rely on large amounts of data to differentiate between legitimate and fraudulent transactions and depend on this input to become more accurate at identifying fraud. If the model is not trained and retrained on a sufficiently diverse and representative dataset, it may not be able to accurately identify legitimate transactions.

What causes false declines?

False declines can occur due to a variety of reasons, the most common of these is when fraud rules incorrectly flag a valid transaction as fraudulent. These rule sets have rigid parameters that block transactions when a single data point is outside of the normal framework, for example:

- Multiple transactions are initiated by a single customer in quick succession

- Different delivery and billing addresses

- The geolocation of the customer’s device is not close to the delivery address

- Unusual high-value orders

- Orders from high-risk fraud regions

Although these triggers may successfully stop fraudulent transactions they also block legitimate customers. Finding the right balance between fraud prevention and false declines is extremely difficult for businesses that rely on manual rules-based systems. Only by incorporating AI and device profiling is it possible to accurately identify both genuine customers and fraudsters.

The impact of false declines

From a customer perspective, the experience of having a payment rejected is not only frustrating, but it can also result in the customer being offended – should they feel that they’ve personally been accused of fraud. Either way, the outcome is that they look elsewhere and the business loses a potentially valuable customer.

When you consider that 42% of consumers agree that they are more likely to tell their friends when they receive a poor customer experience rather than a good one – and that disgruntled customers are likely to vent their frustration on social media – the impact of a false decline may well reach beyond the individual affected to include long-term damage to a brand’s reputation.

These knock-on effects of false declines can be even more severe than the immediate loss of revenue for an online merchant. The cost of false declines also extends beyond the value of the goods as merchants still pay fees to their payment providers for declined transactions. Customers may also contact the merchants’ support centre to demand answers as to why their transaction has been declined, thus incurring additional expense and effort.

How much do false declines cost online merchants?

There is a significant range in the figures associated with the cost of fraud versus the cost of false declines. At the high end of these figures, some companies suggest that false positives cost online merchants up to 70 times more than fraud does. According to CMSPI data from 2022, false declines cost online merchants six times more than what they lose to fraud.

The Merchant Risk Council (MRC) gives a different perspective in their 2022 Global Payments and Fraud Report. Their research shows that 2.6% of international eCommerce orders were false declines, compared with the 3.4% that were fraudulent. Despite this large difference in the figures, the point is clear – outdated fraud prevention systems that produce a large number of false positives can end up costing a business a similar amount or even more than what they lose to fraud.

Our research suggests that many businesses have still not appreciated the full impact and cost of false declines, as only 32% of business respondents use false decline rates as a metric to measure their fraud prevention performance. This indicates that many businesses are yet to quantify their year-on-year losses from false declines and therefore have difficulty understanding the magnitude of the problem.

This situation is compounded by the fact that it is incredibly difficult for businesses to accurately measure the true cost of false declines. There is no way to estimate the impact that a decline has on a customer and what the ripple effect of that may be. This means that even by calculating the loss of revenue, associated fees, service centre expenditure and wasted marketing campaign expenses involved with a single false decline the total cost goes far beyond that – to include the loss of potential future sales and a tarnished reputation.

Reducing false declines: what’s the best solution

The only way to respond to the advanced strategies used by fraudsters is to deploy an equally sophisticated response. Purely rules-based fraud prevention cannot keep up with the threat of fraud but it is still a useful arrow within the quiver of any business’s fraud detection strategy.

The best way to combat fraud and reduce false declines is for businesses to combine AI Machine Learning models with unambiguous rule sets and device profiling. The power of AI allows businesses to assess vast amounts of data and infer correlations that indicate fraud at a level far beyond the capacity of the most advanced human fraud specialists.

When this ability is used in conjunction with device data points to create rules, the result is a fraud prevention system that can reliably differentiate between real customers and fraudsters with unprecedented accuracy. These systems can also classify transactions and deliver a recommendation in close to real time – which greatly improves customer experience and ensures a smooth checkout or application process.

Is your business looking for an AI fraud prevention solution?

Experian understands that businesses need to reduce their fraud losses without negatively impacting their conversion rates. To meet this need we created a fraud prevention solution that focuses on growing revenue through fewer false declines.

As global leaders in fraud prevention, we have the experience and resources to help you through each stage of setting up and maintaining a custom-tailored fraud solution for your business. Contact us to find out how we can help you combat fraud while still growing revenue.