How does AI/ML work to detect and prevent fraud?

AI-driven Machine Learning (ML) is a critical component of an effective digital fraud prevention strategy. The power of this technology is that it can make subtle connections between fraud indicators that are not apparent to human fraud specialists. This capability means that AI/ML can identify and prevent fraud far more accurately than manually created rules alone.

Another key benefit of AI/ML is that it can continually evolve and adapt to an ever-changing fraud threat – some ML fraud monitoring solutions provide automatic retraining every few weeks. This flexibility is essential to keep pace with increasingly organised and sophisticated fraud attack vectors.

In this Q&A article, we look at a range of AI/ML fraud prevention questions to give you an understanding of how this technology works. For a more in-depth view of ML fraud prevention, we invite you to read our extensive guide.

What is ML-based fraud detection?

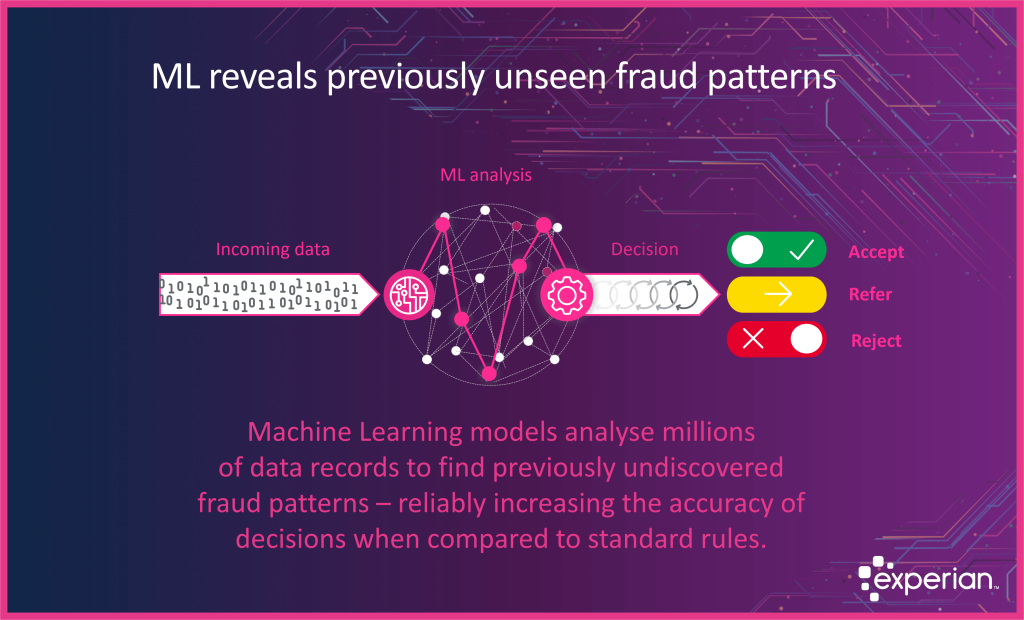

Machine Learning based fraud detection uses complex algorithms to understand fraud patterns from previous transactions and then predicts the likelihood of fraud in new transactions. The models are trained using vast amounts of data to automatically classify transactions much faster and more accurately than a rules-only fraud system – to prevent fraud while still providing a smooth journey for legitimate customers.

How does Machine Learning detect fraud?

Machine Learning can detect fraud by making connections between different types of fraud signals. It learns what these fraud indicators are from historical datasets and each individual indicator contributes to an overall fraud risk score. If the risk score is above a preselected limit the transaction is blocked or flagged for manual review.

Why is AI/ML the best way to detect and prevent fraud?

AI-powered Machine Learning is the best way to detect and prevent fraud because the algorithms are trained using millions of data points – far more than was previously possible. This improves the relevancy of fraud detection as businesses can use their own data for training. The resulting models are highly accurate at identifying business-specific threats and can automate fraud decision-making to provide near-instant recommendations without impacting legitimate customers.

Why is AI/ML suited to fraud detection?

ML is well suited to fraud detection due to the constantly evolving nature of fraud. As the fraud threat changes only AI can identify the new patterns fast enough for businesses to respond before suffering losses. Without AI it can be weeks before a business realises that a new type of fraud is taking place, with significant damage done before they update their rules. ML fraud models can identify new fraud patterns more accurately and much faster than traditional methods.

How does an ML model adapt to changing fraud patterns?

ML models adapt to changing fraud patterns by constantly monitoring transactions and identifying anomalies in relation to the trained data set. Once identified these new fraud indicators can be used to create up-to-date rules that block similar transactions or flag them for manual review.

Is it possible to customise an ML model for a specific business?

Yes. A comprehensive ML fraud model will allow a business to use their own data – and industry peer data – to learn the difference between normal and fraudulent transactions. This customisation allows ML models to better identify fraud types specific to your business environment.

Are ML fraud prevention models scalable?

ML fraud models are highly scalable to meet peak transaction events and business growth. Continual model retraining means the fraud recommendations become more accurate as more transactions are evaluated. Increased accuracy results in fewer transactions that require manual review thus enhancing the scalability potential.

Can ML models provide transparency in terms of how a decision was made?

ML models can be designed to show which features of the algorithm led to a decision. This means that the reasons behind every decision are explainable – so the user can show the customer why their purchase or application has been declined. This can also be used for regulatory auditing purposes. ML explainability is likely to become a legal requirement as AI legislation falls into place.

How can you avoid bias in an ML fraud model?

You can avoid bias in an ML fraud model by ensuring that your training data does not contain any prejudices. Data scientists need to analyse the training data and remove sensitive data points such as age, gender and ethnicity. Human oversight is essential during both the development and subsequent performance monitoring of ML fraud models.

How do ML fraud solutions reduce false declines/positives in fraud detection?

ML fraud solutions can reduce false positives in fraud detection due to their accuracy in classifying both genuine and fraudulent customers. By making subtle connections between fraud indicators an ML model can differentiate between good and bad customers far more precisely than a human can, and more accurately than the software solutions that predated ML.

Are you looking for an ML fraud solution

Experian has a range of fraud prevention and identity verification solutions – including our latest transactional fraud solution called Aidrian. We can help you through each stage of setting up and maintaining a customised ML fraud model tailored to your specific fraud prevention requirements.

We operate across 45 countries and have decades of experience working with AI and developing effective ML models. For further information contact us today to speak to a local consultant.