Improving credit decisions with AI

Although inflation is gradually easing in some regions, it is likely to remain elevated in the near term. As a result, most central banks are choosing to keep interest rates high, which increases financial pressure for consumers, many of whom are already under strain due to cost-of-living expenses.

To successfully navigate this landscape, Financial Services and Telco providers need access to the largest possible datasets consisting of both traditional and non-traditional data. However, access to data is only the first step, as discovering nonlinear relationships in this data requires the advanced analytical capability of Artificial Intelligence (AI).

Experian’s recent AI research – conducted by Forrester Consulting – indicates that nearly 4 out of 5 senior business leaders (79%) consider the adoption of advanced analytics with AI/ML capabilities as a top priority for the next 12 months. In this article, we discuss why this technology has become essential and how it is already delivering a positive ROI for those early adopters.

For an in-depth look at how AI and ML can help improve credit decisions, I invite you to watch the interview below. It includes a detailed exploration of the key advantages that AI can provide in reducing credit risk, according to one of Experian’s top data scientists – Leandro Guerra.

Key business metrics driving AI adoption

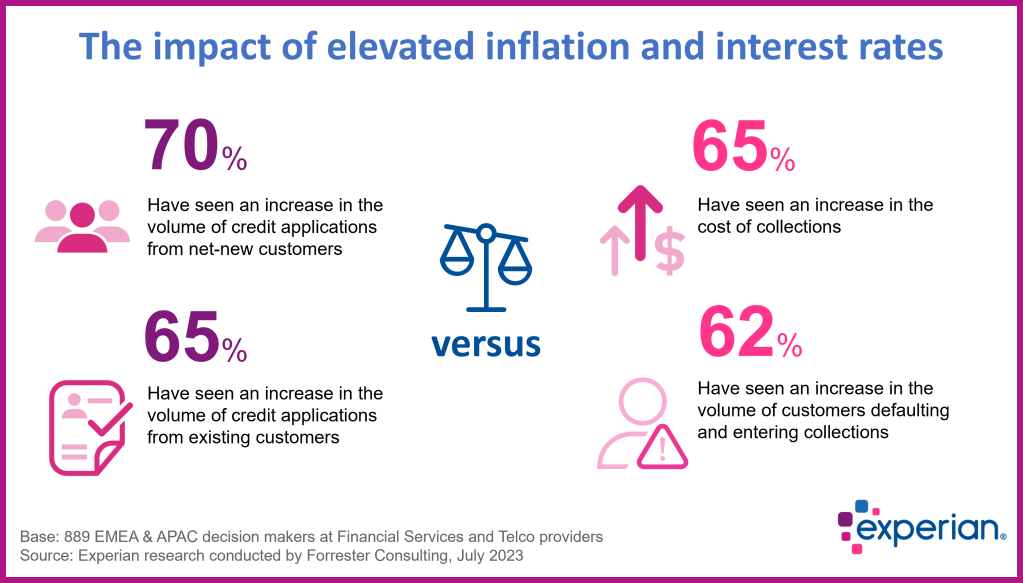

Our research shows that over the past 12 months, there has been a surge in both new applications for credit and in the volume of customers defaulting.

70% of the Financial Services and Telco leaders in our survey have seen an increase in the volume of credit applications from net-new customers, with 66% seeing an increase in the volume of credit applications from existing customers.

At the same time, 62% of respondents have seen an increase in the volume of customers defaulting and entering collections. And there is a corresponding increase in the cost of collections for 65%, with 1 in 2 seeing an increase in their level of bad debt.

Many business leaders recognise that this situation is likely to be a major hurdle in relation to credit risk assessment. Nearly two-thirds (65%) anticipate that the impact of inflation will put a squeeze on income and result in a rise in defaults over the next three years.

As increasing financial pressure drives more consumers to borrow, this creates new opportunities, but managing the risk involved becomes critical to support these potential customers through this challenging time. The best way to understand and mitigate this risk is by analysing a wide array of data sources with AI/ML.

Why AI is becoming critical for credit decisions

Understanding each customer’s unique financial situation is paramount to ensure responsible and sustainable lending. While there are a range of alternative datasets available, their benefit is only being realised thanks to the recent advances in the analytical capability of AI, which means they can now be used to augment traditional bureau data.

Our research shows that many business leaders are investing accordingly, with the top two areas receiving year-on-year budget increases being data-driven customer insights (46%) and AI/ML-based services (45%).

Customers can now choose to share transactional data related to spending habits via Open Banking. Analysing this transactional data with ML allows businesses to improve the accuracy of their credit risk assessments, whilst giving more control to consumers who want to demonstrate good financial management. In addition, it allows the credit assessment process to happen much faster than traditional underwriting, and be fully automated, to provide the customer with a near-instant decision.

AI enhanced Early Warning Signals

Aside from credit decisioning, AI can also enhance Early Warning Signals (EWS). Improving the accuracy of vulnerability detection using AI-powered EWS was highlighted in our research by 62% of respondents as a major hurdle to overcome in the next three years.

By using AI to analyse alternative data – such as web data, economic forecast data and customer voice analysis from call centre conversations – businesses can proactively identify and engage with customers before they enter collections.

This proactive approach can reduce credit losses as vulnerable customers are offered customised restructuring and forbearance solutions before they move into delinquency. Many firms have recognised this, with 34% already using AI/ML within portfolio monitoring to identify predelinquent customers, and 39% planning to invest in this area in the next 12 months.

Data as an enabler of AI

Those businesses that plan to invest in AI in the near future need to ensure that they have access to sufficient data to power these advanced analytical engines. This was a key challenge identified in our research, with 42% of respondents stating that a lack of data to help assess the creditworthiness of customers was limiting the success of their analytics programs.

As a consequence of this, 75% are prioritising investments in new data sources to better understand risk and affordability within their customer onboarding initiatives. I have already mentioned some key alternative data sources, such as transactional data from Open Banking. Sourcing and combining a range of alternative datasets is now allowing organisations to solve a long-term problem related to a lack of data.

However, an exciting and relatively new option to enhance the accuracy of models is the use of synthetic data created with Generative AI. This can be used to fill in gaps in data sets and to simulate hypothetical risk modelling scenarios.

Are you looking to improve your credit decision capabilities?

Experian has been using ML to enhance our clients’ credit risk assessment for over 20 years. Our local consultants can advise you on which of our products and services can help you optimise your decisioning process with the right data and analytical tools to drive growth in these uncertain times.

Contact us today to speak to a representative and for more information about our latest AI research report, simply fill in the form below to receive a complimentary copy.