Why is cloud critical to AI adoption?

As many Financial Services and Telcos look to improve the accuracy of their credit risk and fraud models through the adoption of AI, cloud has become an essential enabler of this process. The performance uplift provided by AI is dependent on the ability to link and collate data from multiple sources in a fast and secure way. Cloud makes it easier to connect data feeds, allowing different internal departments to safely work with data from a variety of sources.

In addition, cloud provides the computing capacity required to ingest and manage the high volume of data that is needed for AI and ML. It provides the flexibility and scalability to enable the software capabilities needed to develop, deploy, and operate models, which ultimately integrates AI into the credit decisioning process.

According to Experian’s recent survey of close to 900 business leaders in Financial Services and Telcos, investing in Software-as-a-Service (SaaS) and cloud technology is a top priority for nearly 4 out of 5 senior decision-makers (79%). This is unsurprising in light of the benefits that cloud provides – such as improved security, faster processing power, reduced maintenance costs and the elastic flexibility to scale as required.

Considering the advantages that cloud provides are well recognised, this article sets out to investigate the challenges of cloud adoption in AI and credit risk management. We explore why some businesses are yet to use cloud in managing these business functions and discuss how these concerns can be overcome.

Snapshot of cloud adoption across EMEA and APAC

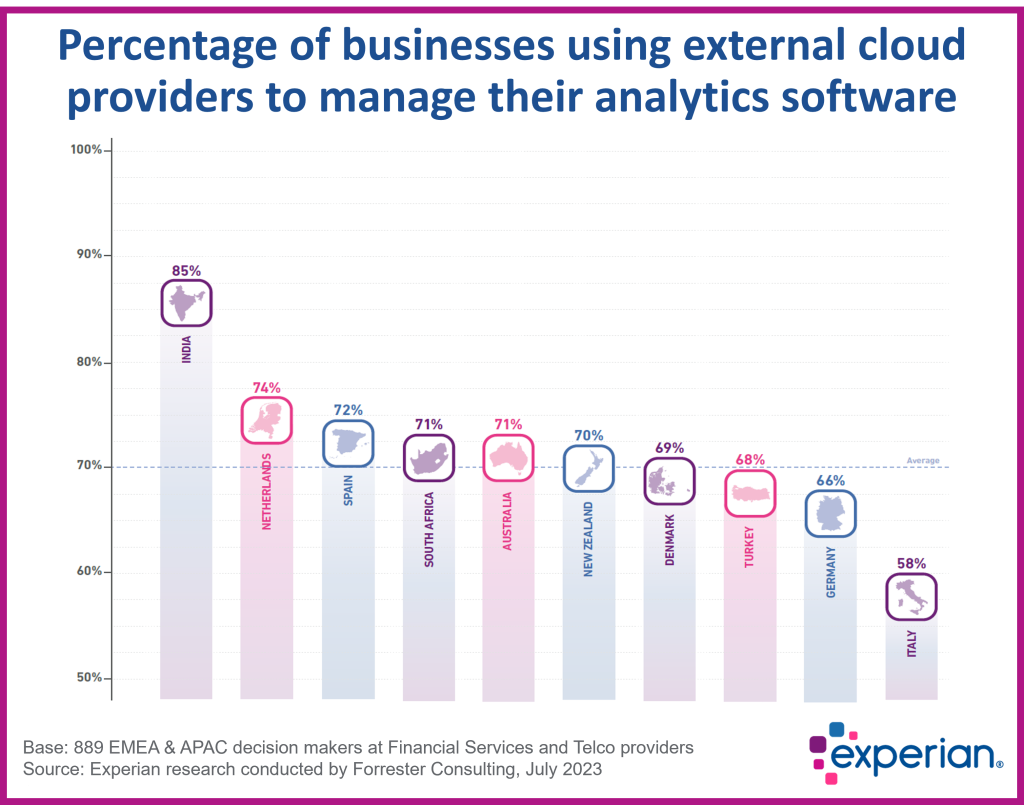

Our research shows that cloud adoption is already well-established, with 71% of business leaders stating that they are using external cloud providers for their credit risk software, 69% for identity and fraud risk, and 70% for analytics platforms.

The graph above shows cloud adoption across a range of countries and indicates that while there is variation in uptake, most countries are within a few percentage points of the average. Of the countries included in our recent survey, India shows the highest adoption and Italy shows the lowest. Both are more than 10% off the average point.

Transition to cloud appears to be inevitable. However, roughly a quarter of firms have yet to make the move. Why is that? This is the question we sought to explore.

Why have businesses not adopted cloud?

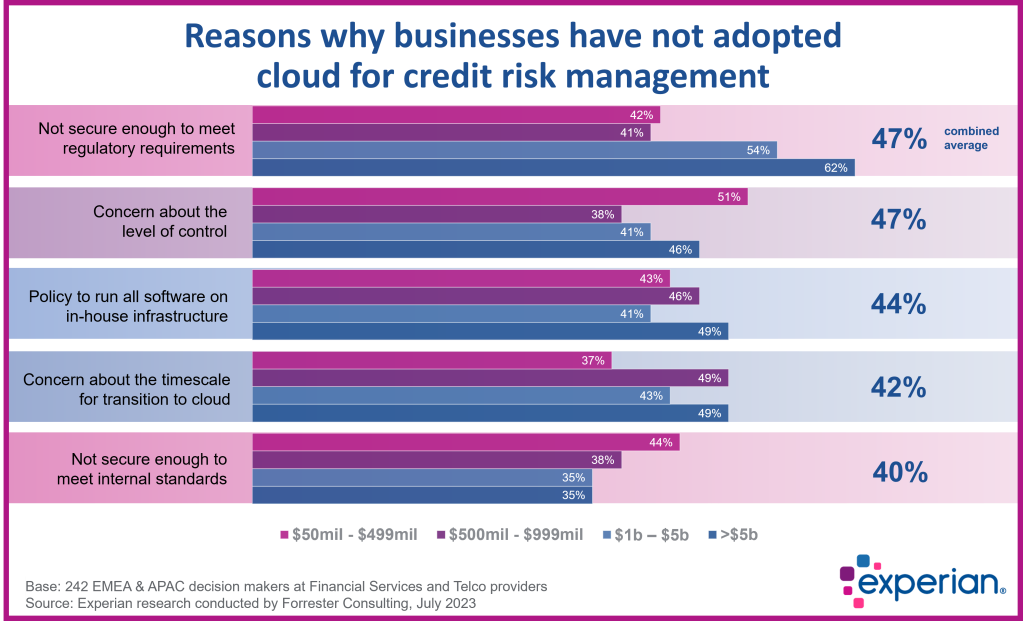

The adoption of cloud differs according to business segment, size, and maturity level. The traditional belief is that FinTechs are better placed to adopt cloud-based services more broadly and at a faster pace, while larger banks must overcome challenges related to the migration of legacy systems and decoupling of complex infrastructure. Therefore, it is interesting to note that based on our research, the top reasons why businesses have not adopted cloud are relatively consistent across the spectrum of business sizes.

Regulatory concerns

According to our research, the top reason why businesses have not adopted cloud for credit risk management is that cloud-based services are not secure enough to meet regulatory requirements (47%). In view of the prevalent use of cloud across all regions and business functions, this may well be due to perception or a business risk position.

Cloud technology, as with other technologies, is part of business technology risk management. Aside from generic data privacy regulations such as GDPR, there are well-established regulatory guidelines on the use of cloud and the associated risk management policies specifically for the financial services sector, such as the EBA Guideline on Outsourcing Arrangements. Understanding such guidelines is a key step to mitigate concerns about regulatory requirements.

Reputable cloud services are now designed to comply with regulatory requirements, with third-party validation and continual updates to ensure compliance. This means that there is actually less effort needed to maintain ongoing regulatory compliance as cloud providers update their services as required.

Cloud providers are also rapidly expanding their options to provide local facilities to address concerns about the storage and transfer of sensitive data outside of territorial borders. For example, Amazon Web Services (AWS) has recently announced the launch of a European sovereign cloud. This independent cloud is located and operated within the EU to further address any concerns around data residency.

Another regulatory stumbling block that has recently been addressed is the issue of on-site audits and inspections. Cloud providers have acknowledged that in some jurisdictions, this is non-negotiable and now allow eligible customers to initiate on-site inspections of their facilities through audit programs.

Level of control

Of equal importance (47%), is concern about the level of control that businesses will have over their cloud-based services. This concern can be addressed by understanding the shared responsibility model in cloud and then making an informed decision about which cloud services to utilise.

In the cloud-shared responsibility model, control and responsibility come together. Those organisations that are looking for extensive control can choose an Infrastructure-as-a-Service (IaaS) model. This allows them control over the use of computing resources, as well as the operating system. It requires them to take on the responsibility of managing these resources and the software on them.

On the other hand, opting for the Software-as-a-Service (SaaS) model releases control of the computing resources, but also transfers the operational responsibility to the cloud provider. Businesses need to understand the shared responsibility model, evaluate the cost-benefit trade-off, and choose a service model which suits them best.

In-house infrastructure policy decision

The third biggest reason – for 44% of respondents – is an organisational policy to run all software on in-house infrastructure. While there may be other reasons for this decision that are not covered in this article, it is likely that this ties into the sixth reason – that some firms do not fully understand the benefits and full impact of adopting cloud-based services.

Apart from cost-efficient scalability and on-demand ability to scale, cloud enables businesses to break down data silos to enhance their decision-making accuracy. As digital customer experience increasingly becomes a competitive differentiator, those firms that delay the move to cloud are likely to be left behind as competitors take advantage of cloud and AI to upgrade their customer journeys.

On-premise to cloud transition concerns

The fourth reason – for 42% of respondents – is concern about the approach and timescale involved with the transition from on-premise to cloud-based applications. Changes of this magnitude do not happen overnight and require careful planning and gradual execution. The good news is that transitioning to the cloud has become much easier in recent times, especially when done in collaboration with an experienced partner.

The long-term value that can be gained from cloud means that this transition is no longer an ‘if’ but rather a ‘when’. Once a business acknowledges this, it allows them to allocate the resources required to make this transition in a manageable way.

Security concerns

The fifth reason delaying the move to cloud – for 40% of respondents – is that cloud-based services are not secure enough to meet internal security policies. This idea may have been true in the past, but the physical and digital security that is now available from cloud providers and their continued investment in security means businesses can now tap into state-of-the-art security features in a much quicker and more affordable way.

In fact, many businesses have shifted from private cloud to public cloud due to the improved, industry-specific security capabilities offered by cloud providers. This includes the highest data encryption standards with multiple layers of protection. Businesses can also choose how security keys are managed, whether they use their own system or a third-party specialist key management provider.

The net result is improved data protection and privacy. Ultimately the reputation of a cloud provider depends on constantly maintaining this high level of security, and they invest a significant amount of time and money into maximising their level of protection for clients.

Cloud as the enabler for AI in credit and fraud risk management

Our research shows that for 67% of business leaders, one of the most important priorities for enhancing their analytical capabilities is investing in cloud-based platforms to manage data more effectively. This is closely followed by moving siloed data sets into a single data lake/warehouse at 61%. Both of these factors are critical to gain the most value from AI.

Secure access to multiple sources of data is critical for the development and use of AI models. There are often multiple departments within a business that simultaneously need access to the same data, so consolidating data within an easily accessible central repository can improve productivity and reduce the time taken for the development of new models. 52% of business leaders agree that externally hosted cloud services are the best way to avoid data silos and aggregate data sources.

The improved predictive accuracy of AI-based models depends on having access to sufficient data storage and processing power to analyse vast amounts of data. Without first developing this capability, businesses are unable to take advantage of the benefits of AI. This is a crucial foundation for ML that we explore in more detail in our guide to ML development.

To learn more – download Experian’s latest AI research

AI is undoubtedly enhancing our ability to assess creditworthiness and prevent fraud. But taking advantage of the improved accuracy that AI models deliver requires a solid cloud foundation from both an infrastructure and software viewpoint.

As the race to reduce risk and provide faster digital decisions is turbocharged by AI, the adoption of cloud becomes an essential stepping-stone in realising AI’s potential.

For more information about how to maximise the opportunity that AI represents, we invite you to read our latest AI research report. Fill out the form below for a complimentary copy.