What is MLOps, and why is it important?

The best way to adapt to dynamic and unexpected changes in the economic cycle is to fast-track the development and deployment of models. As financial pressure changes patterns in loan repayment behaviour, being able to update and deploy new models into decisioning software in weeks rather than months is truly a game-changer.

Experian’s latest credit risk research of over 1,300 senior business leaders at Financial Services and Telcos found that around half of respondents (48%) are updating their models more frequently than ever before. While there are a variety of factors that contribute to this need for faster analytics cycles, it’s clear that MLOps is playing an increasingly important role in business agility.

As we look ahead, it is likely that efficient MLOps will be a key differentiator in the medium term, providing a competitive advantage to those organisations that can rapidly adapt their credit risk models as conditions change. Our research shows that more than half (54%) of decision-makers believe that MLOps will play a key role in shaping the credit industry over the next 3-5 years.

But what exactly is MLOps? And how can the model deployment process be reduced to just weeks? This article discusses how a unified end-to-end model platform can help lenders fast-track their journey from raw data to better credit decisions.

Why do credit risk models need to be updated in faster cycles?

Although the global economic outlook is brightening, the threat of higher-for-longer interest rates and geopolitical-driven supply chain disruption remain. The impact of this financial pressure is reflected in our research findings, with customer hardship due to economic pressure pinpointed as the biggest challenge in relation to credit risk. This was closely followed by the impact of inflation causing a squeeze on income and a corresponding rise in defaults.

In addition, new regulations requiring businesses to adjust their risk management strategy are causing changes to models. As a result of these macroeconomic and regulatory factors, businesses need to update their models more frequently. This is crucial, as models often show degradation after just 12 months due to environmental changes and drift in the data.

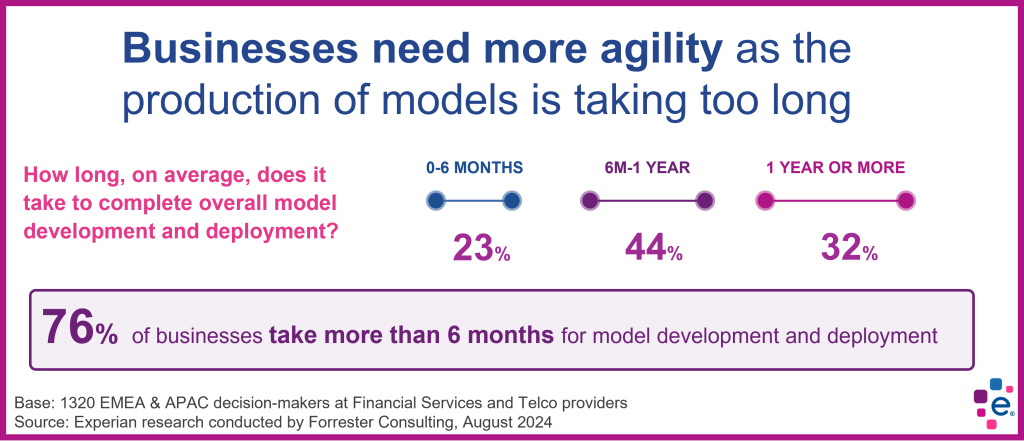

Three-quarters of businesses take more than six months to push models into production

More than half of our research respondents (55%) agree that developing and deploying models takes too long. This has consequences beyond increased costs, as the accuracy of the model’s data is also at risk—which ultimately means less accurate decisions.

Less than a quarter (23%) are currently able to go live with models in less than six months. These organisations have a significant advantage over their competitors as they can respond with much greater agility. This leads to more accurate credit decisions and faster ROI on analytics investments.

What are the biggest challenges associated with model production?

Apart from the time to deployment, the second biggest pain point highlighted in our research is the integration of models into existing workflows. This disconnect between model development and decisioning software often results from the need to re-code models from their original development code into a coding language recognised by a decision engine.

This issue is compounded by the non-linear workflow pattern that is usually required to optimise models. This back-and-forth between data preparation, model engineering, deployment and monitoring can cause significant delays. The complexity of these workflows is exacerbated when different databases and tools are required.

How to optimise MLOps to fast-track model production?

The ability to build, deploy, and maintain high-performance models is only as good as the architecture that supports it. By integrating data, analytics and decisioning into a single platform, lenders can fast-track the data-to-insight-to-action process.

Simplify access to data

A key aspect of this approach is demolishing data silos. Our research shows that organisation-wide access to data is the most critical priority for 57% of data and analytics leaders. Without this solid foundation, improving the speed of model production is extremely difficult.

This point was further emphasised as the biggest analytics-related challenge limiting success in achieving wider business objectives. A unified data platform can help lenders integrate siloed datasets with analytical tools to improve analytical capability significantly.

Take advantage of pre-configured credit attributes

Cleaning and preparing raw data to use as features within models is a labour-intensive process that can often take more than six months. For a third of our respondents, this step alone takes more than a year and could represent over 70% of the time for model development, excluding the additional time for deployment.

Moreover, turning raw data into credit attributes was singled out as the biggest challenge associated with developing ML models.

Using pre-configured credit attributes can significantly improve the accuracy of the model – with as much as a 20% improvement in the models’ performance.

Streamline deployment into production

Another vital factor is to eliminate the need to re-code and package models before moving them into production. This gives analytics teams ownership of the models all the way through the development and deployment process. Not only does this lead to faster analytical cycles, but it can also improve data scientist job satisfaction.

Integrating ModelOps with decisioning simplifies and encourages collaboration between different departments, as model monitoring and strategy performance can work hand-in-glove to enhance the precision of credit decisions.

Maximise the GenAI opportunity

Although Generative AI (GenAI) is not yet suitable for credit risk models due to the unexplainable nature of its outputs, there are several applications where it can improve MLOps processes and reduce the time required to deploy models.

Experian is launching several groundbreaking GenAI solutions – to automate the production of auditing and regulatory documentation, in complex unstructured data extraction and classification and as a model monitoring assistant. In addition, developing synthetic data for data augmentation or data privacy is another key application of GenAI in credit risk.

Key takeaways – Why a unified data and analytics platform is critical to faster MLOps

ModelOps is ultimately the process of simplifying and streamlining the model lifecycle. To facilitate this process, Experian has created a user-friendly unified platform that integrates all the data and technology you need to develop and deploy models in weeks rather than months and years.

The benefits of this unified experience can be summarised as follows:

- Simplified model governance and audit requirements

- Standardised workflows for faster time-to-market and improved scalability

- Full ownership of models by data scientists without reliance on IT for re-coding

- Drag-and-drop interface between model development and deployment into decisioning solutions

- Greater collaboration between departments and teams

- Faster model registration and automated version control

- Automated software updates

- Single sign-on for employees with access according to their authorisation level

The future of MLOps starts now…

Contact us today to speak to a local expert and take your credit decisioning to the next level.

For more information about our research, conducted in partnership with Forrester Consulting, you can simply fill out the form below, and we will send you a complimentary copy of our latest report – Strategies for growth: Perspectives from the boardroom.