Organisations recognise that a seamless journey is critical, regardless of channel, and that asking customers to combine digital and physical interactions is a detractor for good customer experience. In onboarding, asking customers who have chosen to apply online to then visit a branch or print and send bank statements are causing unnecessary friction. The result is frustration, abandonment, and ultimately missed sales.

How can biometrics help?

The obvious answer is that biometrics represent a way to establish identity trust in a digital world. Fingerprint scanning, facial and voice recognition, and even behavioural biometrics, are all methods of identification which can be implemented by organisations to help with KYC and fraud prevention. Onboarding is increasingly about the ability to service customers quickly and efficiently whilst removing manual steps for the customer. Biometrics are being used to support a digital-first approach.

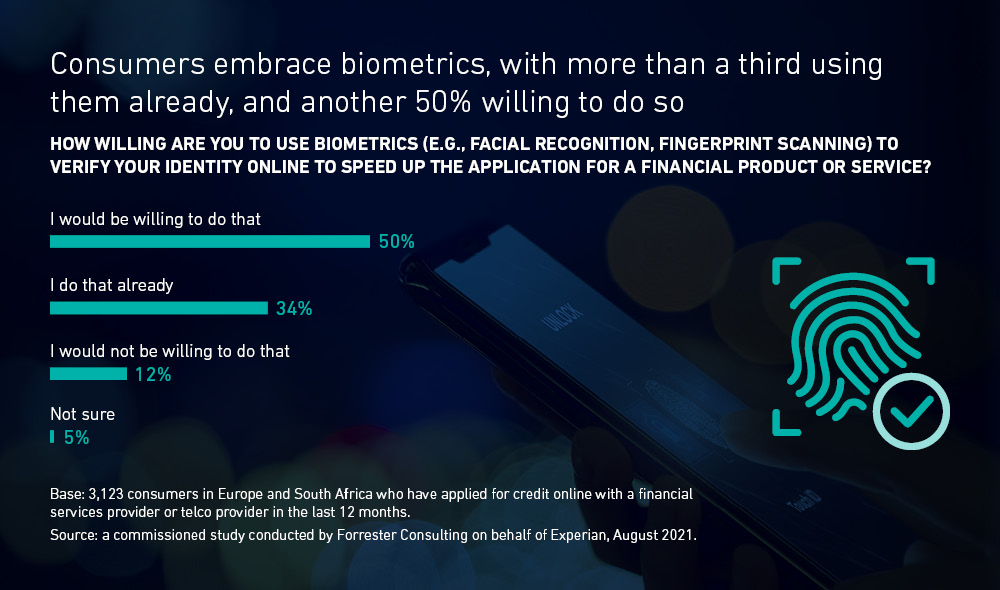

However, our recent Forrester research suggests the use of biometrics is still limited throughout EMEA when it comes to completing applications for financial products and services. 34% of consumers have already used biometrics to verify their identity online when applying for finance, but a further 50% would be willing to do so. What is interesting is that 50% are ready to use biometrics but are yet to experience this for a financial product or service application. The use of biometrics is therefore being under-utilised, suggesting many organisations are relying on customers to prove their identity with a manual process. Biometrics play a critical part in helping businesses implement a fully digital process.

How biometrics can simplify the onboarding process

Selfie ID Authentication: To support identity checking, facial recognition can used to help verify an applicant – a process often referred to as Selfie ID Authentication. The process of taking the selfie involves liveness detection, which looks for facial movements such as blinking to ensure that the person is real and not simply using a doctored image or photograph. The Selfie ID is then matched against the verified ID document (uploaded separately) to prove the person is the true owner of the claimed identity.

Identity Verification via Open Banking: PSD2 provides a way for organisations to access powerful transactional data from customers providing consent has been obtained. This data is gathered from the customer’s banking app, which is typically accessed via biometrics like facial or fingerprint recognition. There may be some additional authentication required but by connecting to the banking app businesses can use data carried in the API to verify identity, such as matching the IBAN (Bank Account Number) with the account holder name, helping to prove that they are who they say they are. And, given that the user must also pass the bank’s own authentication process as part of the consent journey, it provides security reassurance with fraudulent access much harder to obtain.

Behavioural Biometrics: A relatively new use of biometrics is the analysis of device behavioural data to support fraud prevention. In this instance rather than analysing physical characteristics, instead behavioural characteristics are analysed to help determine a genuine user. Behavioural biometrics works by analysing things like screen navigation, movement control, and even touch screen pressure to assess if the behaviour is typical of human characteristics. For example, a fraudster using data acquired illegally will be unfamiliar with specifics of the data and are likely to repeatedly delete and amend. They are also likely to be highly familiar with the layout of online forms, and navigation through account opening processes. In contrast, a genuine customer’s behaviours will typically be at a different pace and navigation which can be analysed in real-time. These are just examples, but behavioural biometrics is already helping to catch fraudsters, and has an additional advantage of being passively checked in the background as to not impact the customer experience for genuine users.

The culmination of these different biometric orientated processes is ultimately a more secure and simplified journey for the customer, reducing time to yes. Less effort proving identity, less time spent finding and submitting evidence of earnings, and less friction as checks occur in the background without an additional customer step. Those businesses that get the digital experience and supporting processes in place first, and implemented to high standard, will benefit while the others catch up.

View the interactive journey to discover the research findings and download to the full findings.

If you are interested in reducing the time to yes in your onboarding journey, you can access our dedicated report here where we discuss key tips to reduce customer friction.