So, what was the problem? The problem was that the average consumer didn’t have a clue what tokenisation was and the idea of storing payment details, something everyone knows when in the wrong hands can have devastating consequences, understandably left many feeling anxious about saving or storing their details.

The solution was fairly simple. Our advice was: tell your customers why they should store them and clearly state how they are kept safe. With a simple message added at the checkout, highlighting the convenience benefit plus the security reassurance of how data was stored, the number of consumers saving their details increased significantly for those retailers.

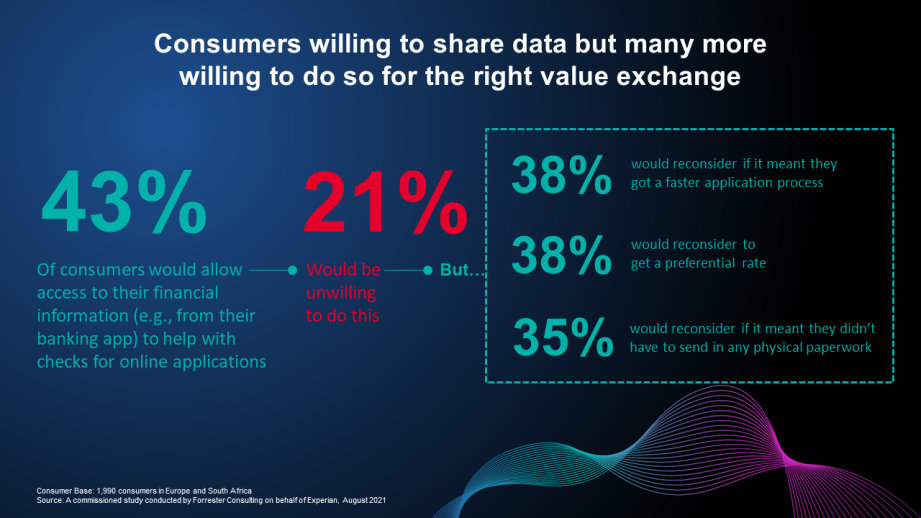

So, what’s this got to do with Open Banking? Our latest commissioned study, conducted by Forrester Consulting on behalf of Experian, has shown that 43% of consumers are likely or very likely to allow financial services companies to access their financial information, such as via a banking app, to help with checks for online applications. But, 33% were neutral and 21% remained unlikely or very unlikely to allow access.

However, what was surprising is the proportion that would reconsider with the right value exchange. 38% would reconsider if it guaranteed a faster application process. Again, 38% would change their mind if in return they could receive a better rate or if they had a better chance of being accepted. 35% would reconsider if it made their life easier and more convenient by removing the need to send in physical paperwork.

This got me thinking about the importance of communication. It reminded me of the impact that a simple value statement had made in my payments example, and how it could be an opportunity to encourage more customers to provide PSD2 consent. I believe that simple communication could be the key to encouraging more customers to enter into a PSD2 journey. In another recent Experian Open Banking survey, 58% of businesses highlighted that slow customer adoption was a major consideration that could deter investment or implementation of PSD2.

Often when connecting to an Open Banking consent journey there is a legal disclaimer and a consent tick box. But how often is there a clear value statement as to why a customer should consent? As our data shows, many consumers that are unwilling to share their data would be open to reconsider if they were given a good enough reason. A value statement could prove a positive tipping point for many of those neutral or unwilling consumers. Remember, the customer might not understand that value without guidance, or maybe they are not used to your new process and therefore it doesn’t feel quite right.

Base: 3213 consumers in Europe and South Africa who have applied for credit online with a Financial Services or Telco provider in the last 12 months

Source: A commissioned study conducted by Forrester Consulting on behalf of Experian, August 2021

What’s the lesson here? Explain the value. For example, Experian works with a client who has used Open Banking to automate data collection and has reduced the time taken to collect customer financial information by 80%.

So, using this as an illustrative example, lets say a typical onboarding journey with Company A took 20 minutes without Open Banking – taking into consideration all the data entry and checks. And with an 80% improvement it now takes 4 minutes with a PSD2 connection where consumers can share their financial information directly. Much quicker and easier for the customer, right? They now don’t need to go and source those transactions and mail them in or upload them to a website.

Now imagine at the point of the process where you need to check the customer’s financial statements, you provide a clear value message: something like “It takes about 20 minutes to do this process manually by uploading your statements, or you can complete in as little as 4 minutes by securely connecting to your banking app and we’ll access your transaction information directly”.

I know which option I’d choose. I am not saying you would word it like I have, but context is everything. Connecting to your banking app to check that the money your friend owes you has cleared is different to connecting to your banking app when you are applying for a loan and you’ve never done it before. It’s a different environment, and a different mindset.

By explaining the value of a process, a benefit, or even a reassurance statement against a key common concern (like security), businesses could go a long way to increase their Open Banking conversion metrics. Communication is key.

Experian’s Forrester Commissioned Report

ViewView the interactive journey to discover the research findings and download to the full findings.