What are the biggest challenges limiting fraud prevention?

The fight against fraud is constantly evolving. Experian’s recent fraud research shows that 71% of the fraud leaders in our survey are struggling to keep up with the rapidly evolving fraud threat. But as new technology creates opportunities for fraudsters, so too does it enable better fraud prevention.

This balance between fraud attacks and prevention is highly dynamic, and the only way to stay ahead of fraudsters is to take advantage of the latest fraud detection technology. The demand for new technology is clear, with 73% of businesses in the survey seeing their fraud losses increase in the past 12 months.

So, what are these critical technologies that can help businesses combat fraud more effectively?

Our research indicates that Artificial Intelligence (AI) and Machine Learning (ML) are now pivotal technologies in this fight, and when combined with device data and biometrics, can help swing the balance in businesses’ favour. In this article, we take a detailed look at the top five challenges that are limiting fraud prevention and explore which fraud solutions can fill these gaps.

Essential fraud prevention layers: ML, device data and biometrics

The graphic below shows the key fraud prevention challenges identified in our research with Forrester Consulting.

1st Challenge – device fingerprinting

According to our research, the biggest challenge limiting respondents’ ability to prevent fraud is a lack of device fingerprinting (56%). Although device data is not a new fraud signal, the incorporation of ML analysis and additional data points means that it has now become an essential tool for effective fraud prevention.

There are three key capabilities associated with device fingerprinting that make it a must-have:

- Rather than a single point-in-time fraud check, device data can be monitored continuously throughout a user session. This continual assessment allows businesses to flag suspicious devices before the user completes the application or purchase.

- Unlike active fraud checks, that introduce additional friction into the user journey, device fingerprinting is a completely passive fraud check. This means customer experience is improved while still retaining high levels of fraud detection accuracy.

- With the rise in synthetic identity fraud, it has become critical to monitor the data trail of each user who interacts with a website.

2nd Challenge – physical biometrics

The second biggest fraud challenge is a lack of physical biometric identity verification (54%). Despite the remarkable development of deepfakes – created with Generative AI – facial recognition combined with active liveness detection is still the current best practice in terms of identity authentication.

The benefit of this type of authentication is that it improves customer experience by providing a fast and simple way to verify identity against a government-issued ID document. The user can simply take a photograph of their ID and then record a short selfie that includes liveness detection. An added layer of security is provided by active liveness detection, where the user is asked to smile or move their head in a certain way to ensure it is a real person whilst also preventing the use of deepfakes.

Although the recent advances in deepfake technology mean that fake static images are virtually indistinguishable from real ones, they are not yet able to respond in real time. This is why active liveness detection is essential to confirm that the user is who they say they are.

For an overview of the crucial role that physical biometrics plays in a layered fraud prevention strategy, watch the video below. It features one of Experian’s top fraud specialists: Wilnes Goosen.

3rd Challenge – multiple fraud solutions

Managing multiple types of fraud prevention software and the associated costs is the third biggest challenge limiting businesses’ ability to prevent fraud (52%). As the fraud threat becomes more complex, there is a growing need to use a variety of fraud solutions to stay ahead. Our research shows that 46% of respondents are using three or more fraud solutions, with the majority using a combination of in-house solutions and those provided by external partners.

Integrating these different solutions in a seamless way requires an orchestration solution that can dynamically call up fraud checks based on the risk profile of the user. To address this challenge, Experian developed CrossCore – a fraud orchestration solution that brings multiple fraud solutions together in a single platform.

The advantage of this approach is that it allows you to connect and manage all of your identity and fraud solutions (both internal and third-party) in a simple and efficient way. This reduces the IT complexity involved with deploying multiple fraud solutions, while also combining the output of each fraud check for a more holistic final decision.

4th Challenge – false positives

The fourth biggest fraud challenge is an inability to align fraud prevention and revenue growth strategies (54%). Central to this challenge is the issue of false positives. According to our research, a staggering 70% of respondents state that false positives cost them more than fraud losses.

To overcome this issue, businesses need to look at the latest technology that allows them to balance effective fraud prevention against high-quality customer experience. Legacy rule-only approaches are no longer sufficiently capable of controlling fraud without introducing large numbers of convoluted rules that ultimately result in high volumes of false declines.

The solution lies with fraud checks that can be continuously and passively monitored, such as device fingerprinting and behavioural biometrics – known collectively as device intelligence. Incorporating these capabilities can significantly improve the detection accuracy of both fraudsters and genuine customers, which means fewer false positives. In addition, they provide the best possible customer experience as they do not interrupt the user journey.

5th Challenge – referrals

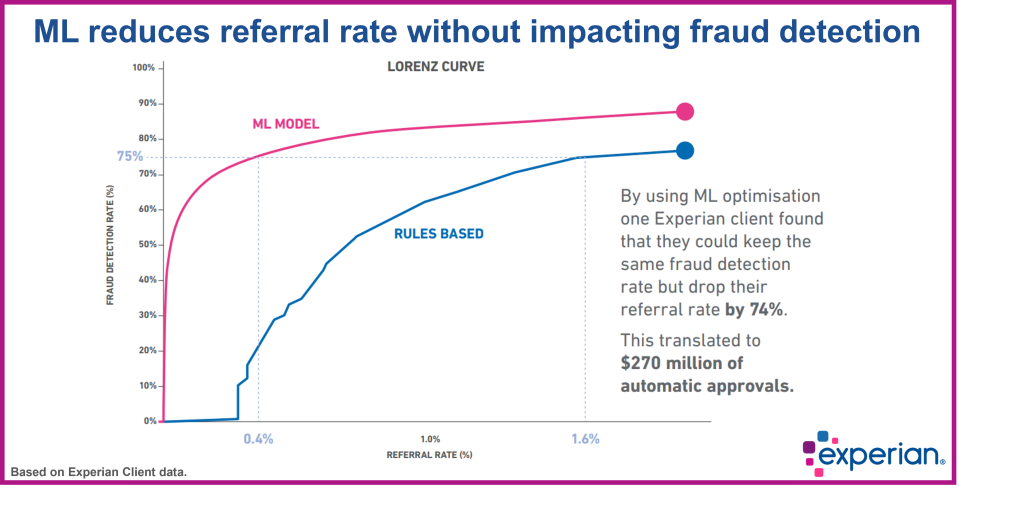

The final fraud challenge is a growing number of referrals, causing increased delays and costs (51%). Large numbers of manual reviews are a symptom of an inefficient fraud prevention strategy. To effectively automate your fraud decisioning process requires a combination of the capabilities discussed above.

By introducing ML-powered fraud solutions that use device and biometric data to near instantly classify users, you can be confident in the accuracy of your fraud detection without relying on manual reviews. The results can be seen in the image below.

Future-proof your fraud prevention with Experian

Experian is on a mission to make the digital world a safer place, and our fraud prevention and orchestration solutions are at the cutting edge of fraud detection technology. As the fraud threat mutates, our fraud solutions continually adapt to help you keep pace and protect your business and customers.

Contact us today to speak to a local representative and find out how to future-proof your fraud prevention process. For a comprehensive overview of the fraud landscape, read our latest fraud research report – simply fill out the form below, and we will send you a complimentary copy.