The future of fraud prevention: device intelligence

As fraud becomes increasingly more complex and automated, finding a balance between effective fraud controls and high-quality customer experience is difficult. The one-size-fits-all approach of traditional rule-based fraud detection is inadequate at preventing AI-powered fraud while still providing genuine customers with a fast and simple application or purchase journey.

Of equal importance is the need to reduce the volume of false positives that are often accepted as an inevitable consequence of fraud controls. According to Experian’s latest fraud research, 70% of the fraud leaders we surveyed stated that false positives cost their organisations more than fraud losses.

The solution to both of these challenges is to use behavioural biometrics and device fingerprinting, together referred to as device intelligence. As the ultimate fraud prevention tools, they allow for continuous and passive fraud checks that can identify the most sophisticated fraud attacks while reducing false positives and ensuring the best possible customer experience.

Watch our “Experian Expert Talks” on device intelligence

In the interview below, Siham Laroub discusses why device intelligence is critical to fraud prevention. Siham is a top fraud specialist involved with the development of Experian’s state-of-the-art fraud solution.

How do device fingerprinting and behavioural biometrics work?

Device fingerprinting

This technology is the equivalent of a digital passport for your device. It works by identifying the unique set of attributes associated with each device. These attributes range from hardware specifications to browser configurations and include data points such as the operating system, screen size, time zone, geolocation and IP address.

Although this technology has existed for decades, its value as a fraud signal has improved over time by incorporating Machine Learning (ML) analysis of additional device attributes. Experian’s most recent fraud prevention solution uses over 150 different device data points to calculate a risk score.

Another key element of this technology is that, unlike a cookie, the data that is collected via device fingerprinting is not stored on the user’s device. Instead, it is stored on the merchant or fraud service provider’s server. This means that the user cannot modify or delete it.

Behavioural Biometrics

Just as device fingerprinting creates a unique set of device attributes for each device, behavioural biometrics can be used to create a unique user profile. It does this by collecting and analysing user behaviour, such as mouse movements, keystrokes or touchscreen pressure and many hundreds of other behavioural attributes.

We each have a distinct and subconscious way of interacting with our devices, and this data can be used to create a set of behavioural attributes unique to each user. In addition, this data can be compared to established fraudster or bot behaviour to add another layer of security. User behaviour provides a powerful fraud detection signal, and analysing data points like the time taken to enter your name can reveal whether the user is legitimate or not.

By comparing each user’s behaviour with a large dataset of established good and bad signals, the result is that genuine customers and fraudsters can be accurately identified in close to real time. This means that fraud detection accuracy improves while also reducing the number of false positives.

Any suspicious activity or known fraud signals will instantly trigger an alert that blocks the transaction from occurring or requires additional identity verification checks. Another advantage is that unlike many fraud prevention techniques, behavioural biometrics does not require the collection of any Personally Identifiable Information (PII).

Why is device intelligence the future of fraud prevention?

As the fraud landscape constantly evolves, there are two key aspects to bear in mind. The first is that fraud rings are becoming increasingly organised, and the second is that fraud attacks are becoming more sophisticated with the use of Generative AI. As a result of these developments, single-point-in-time fraud prevention measures are no longer sufficient.

Instead of having a single fraud check that, once passed, gives users complete access to a business’s website, it is now necessary to continuously monitor each user session for fraud signals. This is where device intelligence stands out, as it allows businesses to continuously and passively monitor their users’ devices and behaviour.

The benefit of this approach is that it has zero impact on user experience as it does not involve any additional checks to complete. Moreover, it can be monitored from the first moment a user starts interacting with a website. This is especially effective at identifying fraud attacks that are otherwise difficult to detect – such as synthetic identity fraud and automated bot attacks – as it depends on user behaviour rather than relying on an analysis of their PII data.

Some analysts refer to device intelligence as an “invisible fraud solution”, and it is exactly this capability, along with its unmatched accuracy in detecting fraud, that makes it the future of fraud prevention.

How device intelligence addresses customer experience challenges

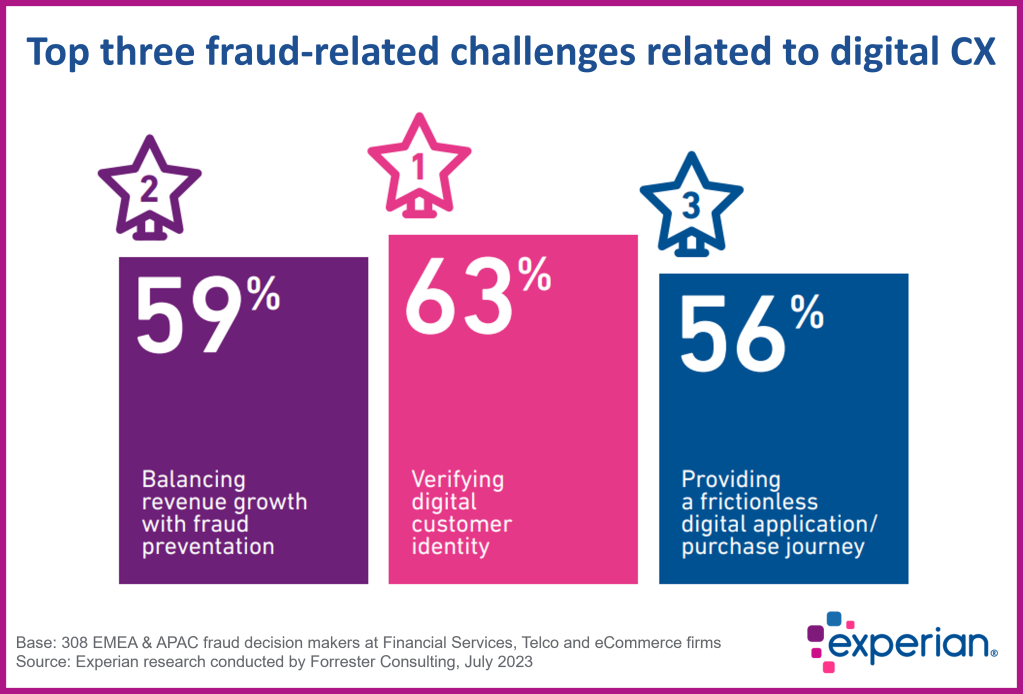

Experian’s recent survey of over 300 fraud leaders shows that the top three digital customer experience challenges can be directly addressed by device intelligence. Let’s break down each challenge for a closer look:

Verifying digital customer identity – interpreting how a user inputs their PII data provides a crucial signal for identity verification, without impacting their journey flow. When this is combined with device data, the result is a highly accurate and completely passive method of identity authentication.

Balancing revenue growth with fraud prevention – at the heart of this challenge is the issue of false positives. The strength of analysing device data and user behaviour is that it allows for a more accurate identification of both legitimate customers and fraudsters. This brings fraud losses down while also reducing false positive rates.

Providing a frictionless digital application/purchase journey – device intelligence is the definitive frictionless fraud check as it happens entirely in the background and does not require any action from the user.

Find out more by downloading Experian’s latest fraud research report

For more information about device intelligence contact Experian today and speak to a local fraud specialist. We have a range of cutting-edge fraud solutions and can help you integrate multiple fraud solutions into a single platform.

To get all the insights from our latest fraud research report, simply fill out the form below, and we will send you a complimentary copy.