How to combat the rise in synthetic identities and account opening fraud

As fraud rates surge across the globe, protecting your account opening process has never been more important. Fraudsters are using identity data from the dark web and the latest Generative AI tools to produce compelling synthetic identities to open new accounts, build trust over a period of months and then vanish without a trace.

Experian’s latest fraud research shows that 67% of Financial Services have seen an increase in synthetic identity attacks over the past year – higher than any other fraud attack method.

So how can you fight back against this menace? What are the most important capabilities you need to identify these sophisticated cyber criminals?

In this article, we discuss five key fraud prevention capabilities that differentiate Experian from other fraud solution providers according to the highly regarded Liminal Link™ Index Report for Account Opening in Financial Services.

What are the essential capabilities to prevent account opening fraud?

Safeguarding your account opening journey requires a layered approach that includes multiple fraud prevention capabilities. Liminal’s Link Index report identifies twenty different capabilities and classifies them according to buyer’s needs.

Of the 150 vendors Liminal assessed in the report, only 24 provide all of the ‘must-have’ capabilities to be considered market leaders. Experian is the only vendor in the report that provides every one of the buyer expectation capabilities.

These include the following key differentiator areas:

-

Document Verification

Verify your customers by asking them to take a photo of their ID document and then comparing this data with government records to authenticate it.

-

Geolocation Intelligence/Data

Collect and compare multiple location signals from your customer’s device to verify their location is accurate and is not being manipulated by an emulator or proxy device.

-

Liveness Detection

Request a selfie from your customer to ensure their physical biometric data matches the photo in their ID document and verify that they are a real person rather than another photo.

-

Customer risk scoring

Include an initial real-time credit decisioning prequalification check during onboarding to determine if the customer qualifies for a credit product.

-

Continuous KYC

Apply ongoing and passive identity verification monitoring to ensure the customer is who they say they are.

Each one of these capabilities provides a strong defence against fraudsters, however, by layering them together, businesses can achieve the most robust fraud defence.

Managing multiple capabilities with a single platform

Orchestrating multiple fraud solutions without making the onboarding journey too complicated is a challenge for many organisations. Different risk signals need to be consolidated into a single assessment to reduce friction and provide an automatic overall decision.

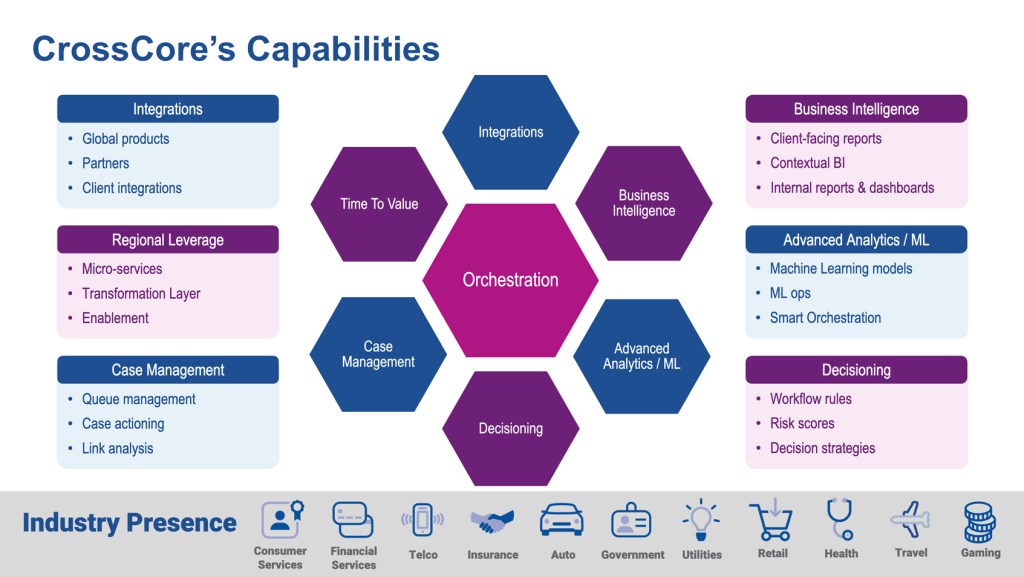

This is why Experian developed CrossCore®, an integrated digital identity and fraud platform that combines multiple fraud solutions in a single cloud-based decision engine. CrossCore allows you to seamlessly connect your own fraud solutions with Experian’s, or other third-party providers’ solutions.

In addition, you can customise decisioning workflows for each customer depending on their risk level. The result is that low-risk customers have a streamlined journey, while high-risk customers must complete further authentication steps. This plug-and-play platform can help you future-proof your account opening process by adding new capabilities as they are developed.

What is the Liminal Link Index Report?

Liminal is a global market intelligence organisation that specialises in supporting executive decision-making in digital identity verification and cybersecurity solutions. They provide advisory services to a wide range of FinTech business leaders, governments and investors.

Their highly acclaimed Liminal Link™ Index Report for Account Opening in Financial Services is a comprehensive research publication that evaluates 150 solution providers to identify the market leaders. The report compares buyer demands against solution capability and buyer satisfaction and then provides a vendor score across a selection of capabilities.

“As the financial services industry faces increasing compliance and fraud challenges, the Link Index Report provides valuable insights to help companies navigate the crowded market and identify buyer opportunities,” says Travis Jarae, CEO at Liminal.

In this year’s report, Experian’s identity verification and fraud prevention solutions received the highest score out of all the vendors evaluated. The findings show that Experian is recognised by 94% of buyers, and 89% identify Experian as the market leader for account opening solutions.

Download the Liminal Link Index report

Liminal’s Link Index Report findings demonstrate the excellent capabilities of Experian’s flagship account opening solution, CrossCore. To find out why Liminal awarded Experian with the top vendor of account opening fraud prevention solutions, we invite you to read the full report.

Simply click the button below to access a complimentary copy.