Telco subscription fraud: is ML the best solution?

In recent years many Telco firms have shifted their focus from traditional services like voice and SMS to focus more on the sale of devices. The vast majority of these sales follow a post-paid subscription model that is highly susceptible to fraud. This issue has been compounded by the rapid growth of digital channels that provide an opportunity for fraudsters to secure the latest devices with only a small downpayment.

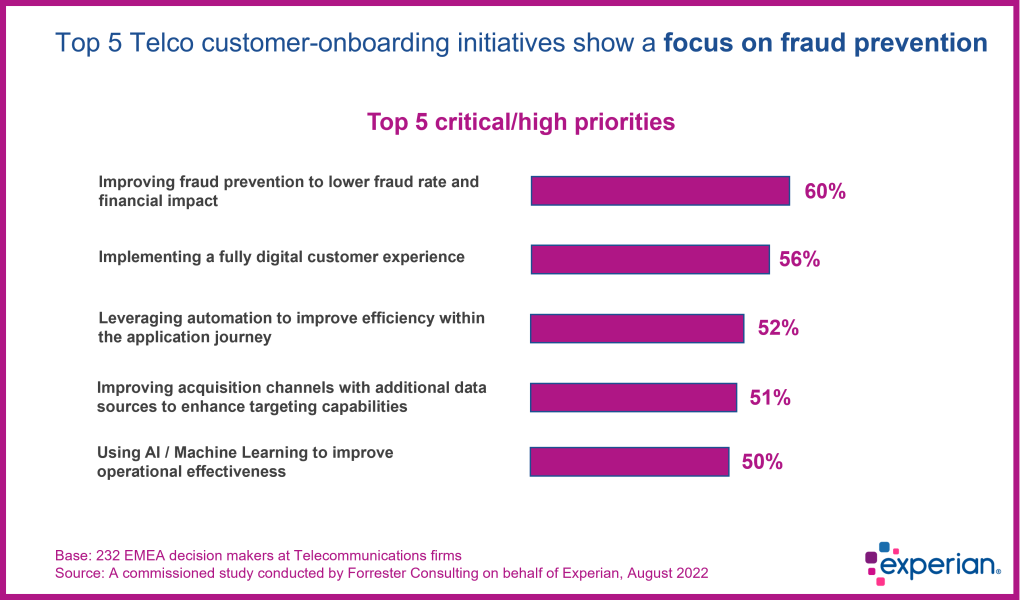

With fraud rates rising across the globe Telco business leaders are increasingly prioritising investments in fraud prevention. Experian’s recent survey of 232 senior Telco executives – based in the EMEA region – showed that improving protection against fraud is a top priority for 3 in 4 (75%). This figure highlights how critical the fraud problem has become as business leaders search to find solutions.

Telco fraud is a complex and multi-faceted problem but for many firms subscription fraud accounts for the largest share of fraud losses. The most effective way to combat this threat is to use technology like Artificial Intelligence (AI) and Machine Learning (ML). This game-changing technology allows you to reliably and accurately detect subscription fraud without having a negative impact on your customer experience.

Understanding Telco subscription fraud

A simple definition of subscription fraud is when a fraudster obtains a mobile device – either by using their own identity, a stolen identity or by creating a synthetic identity – and then fails to make any subsequent payments. These devices can then be resold for a considerable profit as the fraudster has only had to pay for the first instalment, which is usually around 20% of the device value.

Detecting subscription fraud can be challenging, especially in the case of first-party fraud. In this scenario, the fraudster uses their own identity documents to pass through identity verification checks. This makes it nearly impossible for traditional fraud detection systems to recognise and prevent this type of subscription fraud as it depends on the ability to identify the intent to pay.

A significant volume of first-party fraud is often misclassified as bad debt rather than fraud. This can have a negative effect on collection costs as firms attempt to recoup a debt that the fraudster has no intention of ever paying.

Another common type of subscription fraud involves the use of ‘mules’. These are individuals who provide their identity documents to a fraudster in exchange for a fee. The fraudster can then apply for as many devices as possible before the identity is blacklisted. Unscrupulous fraudsters often target international students or transient individuals that may be tempted to provide their identity details shortly before they leave a country.

Third-party subscription fraud occurs when an innocent victim has their identity stolen or when aspects of a stolen identity are combined with fabricated data to create a synthetic identity. These synthetic identities are useful to fraudsters as they allow them to make multiple subscriptions without the real owner of the identity becoming aware of the situation.

Why Telco subscription fraud is on the rise

Over the last few years, there has been a considerable increase in the amount of data leaked through data breaches. During 2022 there were close to 1,800 data breaches with an astounding 392 million victims in the USA alone. A large proportion of this data ends up for sale on the dark web.

With such huge volumes of identity, payment and account data available online it becomes relatively easy for fraudsters to purchase enough data to create detailed synthetic identities. This is having an impact on a wide range of digital industries but is particularly relevant to device subscription fraud as the high margins in this type of fraud make it appealing to fraudsters.

Global macroeconomic conditions are only compounding this problem as many regions struggle with high inflation and increasing cost of living. In this challenging environment, a growing number of people are looking for alternative income streams and are willing to commit fraud to meet their expenses. Fraudsters are openly advertising their ‘services’ on social media platforms and selling fraud tutorials and guides.

At the same time, customer expectations for convenience and simplicity are pushing Telco firms to provide fast and easy application journeys to stay competitive. This is a difficult balance to successfully achieve as reducing fraud checks can provide an opportunity for fraudsters. Those Telco firms that use ML to passively screen potential customers stand to be at an advantage as this method of fraud prevention has no impact on customer experience.

How AI and ML reduce Telco subscription fraud

Telco firms have traditionally relied on rules-based fraud prevention systems to identify subscription fraud. These systems depend on fraud agents understanding fraud patterns and creating rules to flag suspicious applications. As more and more rules are added these rule sets become convoluted, which can result in a large number of false positives – legitimate customers that are incorrectly classified as fraudsters.

In comparison to rules-only systems ML provides a step change in fraud detection and prevention. The power of ML is that it learns from previous fraud cases to make connections between fraud indicators that are not apparent to a human. Combining device data with ML analysis provides an in-depth understanding of customer behaviour that delivers unprecedented accuracy in identifying fraudulent behaviour.

ML fraud systems automatically evaluate each customer throughout their application journey so that good customers are unaffected and fraudsters are reliably detected. By providing a fraud risk score businesses can choose their risk appetite and every case that is referred for manual review can be added to the ML model. This means that the system becomes more accurate with each new case and allows it to continually adapt to the latest fraud trends.

With enough data from previous fraud cases ML models can identify the subtle indicators associated with synthetic identities and ‘mules’. These types of fraud are nearly impossible to identify with manually created rules but with ML it becomes possible to detect and block them before the fraudster can complete their subscription.

Are you looking for a subscription fraud solution?

As Telco subscription fraud becomes increasingly complex – with sophisticated tech-savvy fraud rings using leaked identity data – ML provides a powerful solution to detect fraud in real-time. ML is the best way for Telco firms to combat the threat of fraud while still providing their genuine customers with a smooth and frictionless buyer journey.

If you’re interested in a state-of-the-art ML fraud solution then contact Experian to speak to your local consultant. Our latest fraud solution is called Aidrian and it combines a formidable ML model with device fingerprinting so you can confidently classify every customer. We have the expertise and experience to help you set up and maintain a cutting-edge fraud solution for your business.